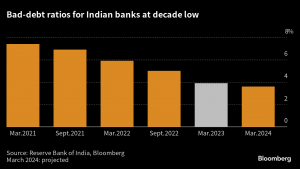

The smooth functioning of financial transactions is crucial for sustained growth of the economy. As the economy grows, the demand for retail credit also increases and with it instances of debt defaults are inevitable. The failure of debtors in honouring their financial obligations not only affects the creditor’s financial stability but also disrupts the overall credit ecosystem. To address these challenges, debt recovery laws in India are put in place. They facilitate the recovery of dues while ensuring fairness and transparency in the process.

Debt recovery refers to the process of collecting unpaid debts from individuals or entities that have defaulted on their financial obligations. It involves various legal and procedural steps undertaken by creditors to recover the outstanding amounts. Debt recovery may include issuing demand notices, negotiating repayment terms, initiating legal proceedings, and, if necessary, enforcing security interests or liquidating assets to recover the debt. The goal of debt recovery is to recover as much of the outstanding debt as possible while adhering to applicable laws and regulations, thereby minimizing financial losses for creditors and restoring the financial health of the debtor.

Debt recovery laws in India play a significant role in ensuring that creditors can recover outstanding debts efficiently while safeguarding the rights of debtors. Understanding these laws is essential for both creditors and debtors to navigate the debt recovery process effectively.

Earlier, India’s Insolvency laws and regulations were governed by the Presidency Towns Insolvency Acts of 1909 and the Provincial Insolvency Act of 1920, but with the evolution, it was realized that these laws were only limited to individual insolvency, and corporations or institutions remained uncovered.

Considering the requirement of comprehensive Insolvency and Bankruptcy laws and also to bring expediency to the process of collecting money from the debtors/ borrowers, the legislation introduced certain debt recovery laws to address the challenges faced by the creditors.

Legal framework of debt recovery in India

The primary legislation governing debt recovery in India is the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. This act empowers banks and financial institutions to recover outstanding loans by enforcing the security interest without the intervention of the court. Under SARFAESI, secured creditors can take possession of the collateral offered by the debtor and sell it without the involvement of the court.

Apart from SARFAESI, the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993, provides a mechanism for the speedy recovery of debts due to banks and financial institutions. The Debt Recovery Tribunals (DRTs) were established under this act to adjudicate matters related to the recovery of debts.

The Insolvency and Bankruptcy Code (IBC), 2016, introduced a comprehensive framework for the resolution of insolvency and bankruptcy proceedings. It provides for the initiation of insolvency proceedings against corporate debtors to facilitate the timely resolution of stressed assets.

Other laws and acts include:

1) The Negotiable and Instruments Act, 1881

This act enumerates the laws which particularly deal with the recovery of money through negotiable instruments such as cheques, promissory notes, and bills of exchange. In cases where the debtor / borrower fails to pay the amount which falls within the purview of a negotiable instrument, the creditor can take legal action under the Act of 1881.

2) The Code of Civil Procedure,1908

The Act comes with legal remedies such as filing an ordinary civil suit against the borrower within the limitation period that is defined under the Limitation Act, 1963. The aggrieved party can also file a summary suit under Order 37 of CPC, 1908, which offers a swift and speedy method to recover the debt or liquidated amount through court proceedings.

3) The Indian Penal Code, 1960

Along with the above mentioned statutory laws, the Indian Penal Code also deals with the penal provisions for debt recovery cases, such as, Section 406 of the IPC states the punishment for committing a criminal breach of trust. Another section that serves the critical provision in debt recovery cases is Section 420, which lays down the punishment for cheating and dishonest inducement of money or property.

Procedures for debt recovery:

- Demand notice: Before initiating any legal proceedings, creditors are typically required to issue a demand notice to the debtor, demanding repayment of the outstanding debt. This notice serves as a formal communication of the creditor’s intention to recover the debt.

- SARFAESI proceedings: If the debt remains unpaid despite the demand notice, the creditor can initiate proceedings under the SARFAESI Act. This involves issuing a notice to the debtor, providing an opportunity to repay the debt within a specified period. If the debtor fails to comply, the creditor can take possession of the collateral and sell it through a public auction.

- Recovery of debts through DRTs: In cases where the debt is not covered under SARFAESI or the debtor disputes the creditor’s claim, the creditor can approach the Debt Recovery Tribunal (DRT) for recovery of the debt. The DRTs have the authority to adjudicate matters related to debt recovery and can pass orders for the recovery of debts.

Insolvency proceedings: In cases of corporate debtors, creditors can initiate insolvency proceedings under the Insolvency and Bankruptcy Code (IBC) if the debtor defaults on a significant debt. The IBC provides for the appointment of insolvency professionals and the formation of a committee of creditors to oversee the resolution process.

Best Pratice for Debt recovery

- Documentation: Maintaining accurate records of loan agreements, security documents, and communication with debtors is essential for effective debt recovery.

- Timely action: Creditors should take prompt action in initiating debt recovery proceedings to prevent further deterioration of the debtor’s financial position.

- Professional assistance: Engaging legal professionals with expertise in debt recovery laws in India can help creditors navigate complex legal procedures and maximize the chances of successful recovery.

- Negotiation and settlement: In some cases, reaching a negotiated settlement with the debtor may be more advantageous than pursuing lengthy legal proceedings and creditors should explore settlement options while keeping their interests protected.

Taking a humane approach

Growing societal awareness of the social and economic impact of debt, coupled with advancements in technology enabling more personalized solutions, is causing a shift in the approach towards debt collections and recovery. Regulatory reforms emphasizing on consumer protection have also played a key role. This shift recognizes the need for compassionate approaches that balance debtors’ financial challenges with creditors’ interests, leading to more ethical and transparent debt collections practices.

Humanizing debt recovery in India involves adopting practices and strategies that prioritize empathy, fairness, and understanding toward debtors while still pursuing the recovery of outstanding debts. In recent years, there has been a growing recognition of the need to balance the rights of creditors with the financial hardships faced by debtors, especially in light of economic challenges and unforeseen circumstances. One approach to humanizing debt recovery is to provide debtors with avenues for open communication and negotiation, allowing them to voice their concerns and explore alternative repayment arrangements that suit their financial capabilities. The Reserve Bank of India has also rolled out several guidelines and mechanisms to keep this in check.

Conclusion

Debt recovery laws in India provide a robust framework for creditors to recover outstanding debts efficiently while balancing the rights of debtors. Understanding the legal provisions, procedures, and best practices is crucial for both creditors and debtors involved in debt recovery processes. By adhering to legal requirements and adopting effective strategies, creditors can enhance their chances of successful debt recovery while minimizing the risks and costs associated with non-performing assets.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What are the main laws governing debt recovery in India?

The primary laws governing debt recovery in India include the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993, and the Insolvency and Bankruptcy Code (IBC), 2016.

2. What is the SARFAESI Act, and how does it facilitate debt recovery?

The SARFAESI Act empowers banks and financial institutions to recover outstanding loans by enforcing the security interest without court intervention. It allows secured creditors to take possession of collateral offered by the debtor and sell it to recover the debt.

3. What role do Debt Recovery Tribunals (DRTs) play in the debt recovery process?

Debt Recovery Tribunals (DRTs) were established under the RDDBFI Act, 1993, to adjudicate matters related to the recovery of debts. They provide a forum for creditors to pursue debt recovery proceedings in cases not covered under the SARFAESI Act or where the debtor disputes the creditor’s claim.

4. How does the Insolvency and Bankruptcy Code (IBC) impact debt recovery in India?

The Insolvency and Bankruptcy Code, introduced in 2016, provides a comprehensive framework for the resolution of insolvency and bankruptcy proceedings. It allows creditors to initiate insolvency proceedings against corporate debtors in cases of default, facilitating the timely resolution of stressed assets.

5. What are some best practices for creditors when pursuing debt recovery in India?

Best practices for creditors include maintaining accurate documentation of loan agreements and communication with debtors, taking prompt action in initiating debt recovery proceedings, considering negotiated settlements where appropriate, and seeking professional assistance from legal experts with expertise in debt recovery laws in India.