With the strengthening of the digital ecosystem, there has been a massive shift in expectations for a seamless customer experience across industries. Today, customers are used to availing purchase transactions and other services at the click of a button. The desire to own the latest gadgets, appliances, and consumer durables is also stronger than ever. However, these purchases often come with a significant price tag, which might put a strain on individuals’ finances. Designed to align with the pace of evolving technologies, consumer durable loans enable consumers to make purchases swiftly, spreading the cost over manageable installments. Consumer durable loans have become a reliable, convenient, and flexible solution to fulfill the purchase aspirations of individuals without depleting their savings. By bridging the gap between an individual’s aspirations and fund availability, consumer durable loans cater to the modern consumer’s appetite for purchase while offering the flexibility of repayment tailored to individual financial capabilities.

Understanding consumer durable loans

Established merchant stores and e-commerce websites liaise with banks and other non-banking lending institutions to extend consumer durable loans to eligible customers. These loans offer the flexibility of repaying the borrowed amount through fixed equated monthly installments (EMIs) over a predetermined period.

In contrast to personal loans, where borrowers receive funds directly, consumer durable loans are a form of retail financing designed for acquiring products. This is accomplished either by using the borrower’s debit card or by automatically deducting the EMI from their savings account.

In consumer durable loans, the sanctioned amount, corresponding to the product’s price, is directly transferred to the merchant’s bank account. It is important to remember that these loan arrangements are typically only provided by specific lenders to qualified borrowers, enabling them to obtain credit for making purchases from reputable brick-and-mortar stores or online marketplaces.

Types of consumer durable loans

The major types of consumer durable loans offered by lending institutions are:

- In-store EMI: Lending entities place representatives across diverse retail establishments, enabling customers to initiate applications for consumer durable loans tailored to their desired purchases. This financing mechanism typically involves an initial down payment, while the subsequent EMIs are computed based on the residual balance. Once the customer chooses the desired product and their eligibility has been determined, documentation is done digitally and the details of the loan are agreed upon.

- Point of Sale (PoS) EMI: Also known as debit card EMI, this is a popular method of acquiring consumer durable loans. To facilitate this setup, lending institutions partner with various PoS companies that install PoS machines at retail stores. Customers who have an EMI facility on their debit cards can avail themselves of this method to acquire consumer durable loans.

- Debit card online EMI: Customers can also choose to avail the EMI facility on their debit cards to purchase consumer durables through e-commerce websites. As opposed to swiping the card on a PoS machine, customers can enter the card details while checking out of the website and set up the EMI at the time of making the payment.

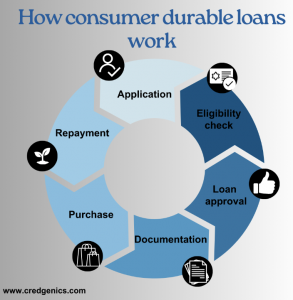

How do consumer durable loans work?

Banks and non-banking financial companies (NBFCs) provide loans for consumer durables. The process typically involves the following steps:

- Application: Customers apply for a consumer durable loan either online or through a physical branch. Some lenders also provide loans through partnerships with retailers at the point of sale.

- Eligibility check: The lender assesses eligibility based on factors such as income, credit score, employment status, and existing liabilities.

- Loan approval: Once the application is approved, the lender informs the customer about the loan amount, interest rate, repayment tenure, and other terms and conditions.

- Documentation: Borrowers need to provide necessary documents like identity proof, address proof, income proof, and, in some cases, the details of the product they intend to purchase.

- Purchase: With the loan amount disbursed, one can purchase the desired consumer durable from an authorized retailer.

- Repayment: Consumer durable loans usually come with flexible repayment options, including EMIs. The repayment period can vary, typically ranging from a few months to a couple of years.

Benefits of consumer durable loans

- Financial flexibility: Consumer durable loans allow customers to acquire high-value items without a significant upfront payment, preserving their savings for other needs.

- Easy approval: The eligibility criteria for these loans are often more relaxed than traditional personal loans, making them accessible to a wider range of individuals.

- Quick processing: With streamlined application processes and online options, one can get approval and disbursement quickly, often within a few days.

- No collateral: Most consumer durable loans are unsecured, meaning that customers don’t need to provide collateral or security.

- Convenience: Some lenders have tie-ups with retailers, enabling individuals to apply for the loan and make the purchase in a single visit.

Considerations before taking a consumer durable loan

- Interest rates: Individuals should compare the consumer durable loan interest rates provided by various lenders to make an informed decision about the most economical choice.

- Additional charges: Potential borrowers should take into consideration any processing fees, prepayment penalties, or concealed expenses linked to the loan.

- Repayment tenure: The selection of a repayment tenure that matches the individual’s financial capacity is crucial.

- Credit score: A positive credit score heightens the likelihood of loan approval and could also result in more favorable interest rates.

- Product quality: Prospective borrowers should verify the quality of the product they intend to purchase and ensure that it originates from a trustworthy retailer.

Consumer durable loan market in India

The consumer durable loan market in India has experienced significant growth and evolution in recent years. This market caters to the increasing demand for various durable goods such as electronics, appliances, furniture, and more. Here are some key points about the consumer durable loan market in India:

- Rapid urbanization and aspirations: Urbanization and rising disposable incomes have led to higher consumer aspirations. Individuals are increasingly looking to upgrade their lifestyles with the latest gadgets and appliances, which has driven the demand for consumer durable loans.

- E-commerce and retail partnership: The collaboration between lending institutions and e-commerce platforms or retail outlets has simplified the loan application process. These partnerships enable customers to apply for loans directly at the point of purchase, making the process more seamless and convenient.

- Tech-driven solutions: Fintech companies have played a crucial role in transforming the consumer durable loan market. They have introduced innovative digital solutions for loan applications, approvals, and disbursals, enhancing customer experiences and reducing processing times.

- Customized loan offers: Lenders are tailoring loan products to suit the specific needs of consumers. This includes offering flexible repayment tenures, competitive interest rates, and pre-approved loan options based on the individual’s credit profile.

- Credit accessibility: Consumer durable loans have contributed to expanding credit accessibility for a wider range of consumers, including those with limited credit history. This has led to financial inclusion by providing access to credit for individuals who might not have qualified for traditional loans.

- Collateral-free financing: Many consumer durable loans are unsecured, meaning borrowers do not need to provide collateral. This has made it easier for individuals to access credit without risking their valuable assets.

- Economic boost: The availability of consumer durable loans has a positive impact on the economy by stimulating consumer spending and demand. It also supports various industries, including electronics, appliances, and retail.

- Risk mitigation: Lenders are implementing advanced risk assessment techniques, leveraging data analytics and credit scoring models to accurately evaluate the creditworthiness of applicants.

- Awareness and education: As the market expands, lenders are focusing on educating consumers about the benefits and responsibilities associated with consumer durable loans, promoting responsible borrowing practices.

Conclusion

In the realm of modern consumerism, consumer durable loans have emerged as the bridge that transforms dreams into tangible reality. As one navigates through the diverse offerings and possibilities, it becomes evident that these financial instruments are not just about acquiring possessions, but about elevating lifestyles and nurturing ambitions. Borrowers are empowered to make informed decisions about their purchases owing to the flexibility offered in terms of choosing the payment terms, method of payment, and repayment options. As buying capacity increases and the role of the internet evolves and expands, the consumer durable loan market is certain to grow.

FAQs:

- What products are included in consumer durable loans?

Consumer durable loans encompass a wide range of products that enhance lifestyles and comfort. These loans typically cover items that are intended for long-term use and offer tangible value. Common products included in consumer durable loans are electronics such as smartphones, laptops, televisions, and home appliances like refrigerators, washing machines, air conditioners, microwaves, and kitchen appliances. Furniture items like sofas, beds, dining sets, and other household furnishings are also part of consumer durable loans. Essentially, any goods that provide convenience, utility, or entertainment over an extended period are eligible for financing through consumer durable loans.

2. What are some of the considerations in determining consumer durable loan eligibility?

When assessing eligibility for consumer durable loans, several critical factors come into play. These considerations determine an individual’s ability to secure such a loan and play a pivotal role in the lending decision. Some important factors include:

- Credit score: A strong credit score demonstrates a borrower’s creditworthiness and responsible financial behavior, increasing the chances of loan approval.

- Income and stability: Lenders evaluate an applicant’s income level and stability to ensure they have the means to repay the loan comfortably.

- Employment history: A stable employment history indicates consistency in income and enhances the borrower’s credibility.

- Age: Lenders often have minimum and maximum age criteria. Younger borrowers may have limited credit history, while older borrowers might face limitations due to loan tenure restrictions.

- Debt-to-income ratio: Lenders assess an applicant’s debt-to-income ratio to determine if the individual can comfortably manage the loan payments alongside other financial obligations.

- Residential stability: Longer periods of residence at one address can indicate stability and improve the applicant’s chances of loan approval.

- Existing financial commitments: Lenders consider existing loans, credit card balances, and other financial obligations to evaluate the applicant’s repayment capacity.

- Type of employment: The nature of employment, whether salaried, self-employed, or freelance, affects the eligibility criteria and required documentation.

- Loan amount: Lenders determine whether a borrower’s financial situation matches the requested amount based on the loan amount requested by the borrower, which may affect eligibility.

- Product value: The value of the product being financed impacts eligibility, with some lenders having specific minimum and maximum loan amounts.

- Credit history: A history of responsible credit management, including timely loan repayments and credit card usage, can enhance eligibility.

- Documentation: Providing accurate and complete documentation, such as income proof and address verification, is crucial for the eligibility assessment.

It’s important to note that different lenders might have varying eligibility criteria and weightage for these factors. Prospective borrowers should research and understand the lender’s requirements before applying for a consumer durable loan.

- What conditions apply to loans for consumer durables with low Cibil scores?

Consumer durable loans for individuals with low credit scores (CIBIL scores) can be challenging to secure, as a low credit score indicates a higher risk for lenders. However, some lenders and financial institutions might still offer such loans, albeit with certain terms and conditions:

- Higher interest rates: Lenders may charge higher interest rates for consumer durable loans extended to individuals with low credit scores. This compensates for the increased risk associated with lending to borrowers who have a history of credit issues.

- Limited loan amount: The loan amount offered to individuals with low credit scores might be lower than what’s available to those with better credit. This helps mitigate the lender’s risk exposure.

- Less time to repay the loan: For borrowers with low credit scores, lenders may impose shorter loan terms for consumer durables. A shorter tenure reduces the lender’s risk exposure and ensures faster repayment.

- Documentation requirements: Borrowers with low credit scores might be required to provide additional documentation to substantiate their income, employment, and address details in order to demonstrate their ability to repay the loan.

- Co-signer or guarantor: Some lenders might require a co-signer or guarantor with a better credit history to support the loan application. This individual becomes responsible for repaying the loan if the primary borrower defaults.

- Collateral or security: Lenders might ask for collateral or security against the loan, which serves as a way to mitigate their risk. This could be in the form of a valuable asset that can be seized in the event of default.

- Limited product options: Individuals with low credit scores might have access to a limited range of products eligible for financing as lenders seek to minimize their risk exposure.