Easy access to formal credit plays a crucial role in achieving personal and financial goals. Unsecured loans, a form of borrowing that doesn’t require any collateral, have been steadily gaining popularity and flourishing in India. They act as a versatile and readily accessible source of funds, often without the need of keeping valuable assets as collateral. Whether one is looking to consolidate debt, fund a business venture, cover unexpected expenses, or simply improve the financial situation, unsecured loans have become a viable and increasingly attractive option, and their rise in consumption over the past few years is in part due to easier access to different types of unsecured loans.

Understanding Unsecured Loans

Unsecured loans, which include personal loans, consumer durables loans, and credit cards, are financial products that do not require borrowers to pledge collateral, such as a car, house, or savings account. Instead, lenders grant these loans based on an applicant’s creditworthiness, income, and repayment ability. The absence of collateral makes the different types of unsecured loans more accessible to a broader range of borrowers, as they don’t need to arrange collateral upfront.

Types of unsecured loans in India

1.Personal loans: Personal loans, a common form of unsecured loans, have seen significant growth. These loans are flexible and can be used for various purposes. The application process has become more streamlined, with online lenders and digital platforms offering a user-friendly experience. Due to their versatility, personal loans can be used for a wide range of needs, such as debt consolidation, travel, urgent medical care, or any other personal financial requirement. NBFCs, banks, and credit unions offer personal loans to individuals. The loan amount is determined based on creditworthiness, monthly income, and other eligibility criteria.

For example, suppose an individual suddenly faces unexpected medical expenses, such as hospital bills or treatment costs, that are not covered by insurance. In this scenario, they may opt for a personal loan to cover these unforeseen healthcare expenses. After the loan is approved, the funds can be disbursed quickly, allowing the individual to address the medical emergency promptly.

2. Credit cards: Credit cards are another form of unsecured credit that allows users to make purchases or obtain cash advances without the need for collateral. The convenience of credit cards and the possibility of earning rewards have contributed to their ongoing popularity. Consider an individual using a credit card for travel expenses. Suppose this person is planning a family vacation and prefers the convenience and flexibility of a credit card. They use the credit card to book flight tickets, hotel accommodations, and other travel-related expenses. By using the credit card, the individual can enjoy benefits such as cashback, rewards points, and travel insurance offered by the card issuer. Throughout the trip, the credit card allows for easy and secure transactions, eliminating the need to carry large amounts of cash. This example illustrates how credit cards offer convenience, rewards, and financial flexibility for various expenditures, making them a popular choice for transactions in India.

As per a report by Statista, throughout the fiscal year 2023, India witnessed more than 2.9 billion credit card transactions, with a total value exceeding 14 trillion Indian rupees. Projections indicate that this figure is set to surge to over 46 trillion Indian rupees by the fiscal year 2027 within the nation.

Number of credit cards in use in India (in millions) 2013–2028: Statista

3. Education financing: Unsecured student loans have become a significant part of education financing. These loans help students cover tuition, books, and living expenses, offering flexible repayment options and competitive interest rates. Consider a student in India seeking education financing to pursue a professional degree. The student aspires to enroll in a reputable university to pursue higher education in a specialized field. Facing the financial constraints of tuition fees, accommodation, and other related expenses, they explore education financing options. The student applies for an education loan from a financial institution or a specialized education financing provider in India. Once approved and disbursed, the education loan covers tuition fees, accommodation costs, and additional expenses like study materials. The education loan serves as a vital financial support system, enabling the student to pursue their academic goals without immediate financial strain.

4. Consumer durable loans: These loans are often offered in partnership with retailers and are intended for the purchase of consumer durables like smartphones, laptops, refrigerators, and furniture. Consumer durable loans allow customers to buy these products on easy installment plans without having to make a lump-sum payment. For example, a consumer in India looking to purchase a high-end home appliance, such as a smart television or a premium refrigerator. The individual may explore a consumer durable loan to facilitate the purchase. In this scenario, the consumer approaches a financial institution or a lending platform offering consumer durable loans. The individual receives the required funds to make the purchase. The consumer durable loan allows for the immediate acquisition of the desired appliance without a significant upfront payment. The convenience and flexibility of consumer durable loans make them a popular choice for individuals looking to upgrade their home appliances without putting a strain on their immediate finances.

A 12% increase in sales volume is expected to fuel the consumer durables industry’s robust 16% revenue expansion in India, which could reach nearly INR 1 trillion for the fiscal year 2023, according to reports.

5. Start-up business loans: Start-up business loans cater to individuals looking to establish or expand their small businesses. Fintech platforms often provide unsecured loans specifically designed for start-ups and entrepreneurs. Let’s consider an entrepreneur in India who has recently launched a tech startup and is seeking a business loan to scale operations. The entrepreneur has developed an innovative mobile app and is looking to expand the team, invest in marketing, and upgrade the technology infrastructure. They apply for a startup business loan from a financial institution or a specialized startup financing platform. They provide a detailed business plan, outlining the startup’s mission, market potential, and growth projections. Upon approval, the startup receives the loan amount, allowing the entrepreneur to execute the planned expansion. The funds contribute to hiring new talent, implementing marketing strategies, and upgrading the technology stack. As the startup grows and generates revenue, the entrepreneur begins repaying the loan in installments, adhering to the agreed-upon terms and interest rates.

Current trends in unsecured loans in India

1.Digital lending platforms: The rise of online lending platforms has made it easier for individuals to access unsecured loans. These platforms often streamline the application and approval processes, providing quick and convenient access to funds. Digital platforms for small business lending focus on addressing the financing needs of small and medium-sized enterprises (SMEs) in India. Using data analytics and machine learning, they assess the creditworthiness of businesses quickly, allowing SMEs to access working capital loans without the need for extensive paperwork. These platforms aim to bridge the credit gap for small businesses and expedite the loan approval process, fostering financial inclusion for entrepreneurs.

2. Fintech innovations: Financial technology (fintech) companies have introduced innovative lending models, leveraging data analytics and artificial intelligence to assess credit risk more efficiently. This has expanded the availability of unsecured loans to a broader audience. Digital lending platforms that focus on providing short-term personal loans to individuals in India use a combination of traditional credit scoring and alternative data sources, including social media profiles and employment details, to assess the creditworthiness of users quickly. They enable users to access instant cash advances or personal loans through a mobile app, catering to the immediate financial needs of salaried individuals.

3. Flexible repayment options: Many lenders now offer flexible repayment options, allowing borrowers to choose terms that suit their financial situation. This flexibility has contributed to the popularity of unsecured loans. ‘Buy now, pay later’ is one of the most popular financing options that allows consumers to make immediate purchases and delay payment to a later date, often in installments. With ‘buy now, pay later,’ shoppers can enjoy the convenience of acquiring goods or services instantly and defer their payments, breaking down the cost into manageable and structured repayment plans.

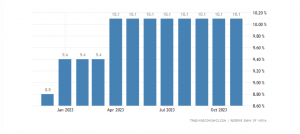

4. Competitive interest rates: Despite being unsecured, competitive interest rates make these loans attractive to borrowers. Lenders often adjust rates based on creditworthiness, encouraging responsible financial behavior.

5. Rise in Peer-to-Peer lending: Peer-to-peer lending platforms connect borrowers directly with individual lenders, eliminating the need for traditional financial intermediaries. This model often results in competitive rates and increased accessibility. P2P lending platforms in India facilitate direct lending and borrowing between individuals. They connect lenders with borrowers, allowing individuals to access loans without the involvement of traditional financial institutions. They employ advanced credit assessment algorithms and risk management techniques to evaluate the creditworthiness of borrowers, enabling fair and transparent lending. This P2P lending model promotes financial inclusion by providing an alternative source of credit to borrowers who may face challenges accessing loans through conventional channels.

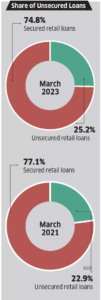

As per the RBI’s Financial Stability Report released in June 2023, unsecured retail loans increased their share from 22.9% in March 2021-2023 to 25.2%, whereas secured loans saw a decline from 77.1% to 74.8%. As of the end of July, banks held an unsecured loan portfolio valued at nearly Rs 12 lakh crore.

Source: RBI

Recent change in norms for Unsecured Loans by the RBI

The Reserve Bank of India (RBI) has recently raised the risk weights on consumer loans provided by banks, non-banking finance companies (NBFCs), and credit card issuers. This adjustment makes it more costly for lenders across the board to extend loans in these categories. Under the existing guidelines, banks are required to set aside ₹8 for every ₹100 lent for personal loans. With the recent changes, this set-aside amount has increased by 25% to ₹10 for every ₹100 lent. It’s important to note that these revised rules do not apply to housing loans, education loans, vehicle loans, or loans secured by gold and gold jewellery.

This move is expected to result in heightened capital requirements for lenders, leading to increased interest rates for borrowers. The elevated lending rates from banks to non-banking entities could potentially have a ripple effect on corporate bonds, causing higher yields and widening credit spreads for non-banking institutions. As a result of the increased risk weights on these loans, bank lending to NBFCs will increase in cost beyond a predetermined threshold. The RBI made its decision in response to the concerns about the quick expansion of some consumer loan categories, which made banks and NBFCs realize they needed to bolster their monitoring systems and put safety measures in place. Credit card receivables are also subject to higher risk weights, which may have an effect on lending rates and result in higher capital requirements and higher interest rates for borrowers. All things considered, banks are encouraged by the change in risk weights to depend more on their credit evaluations than on lending to NBFCs.

Conclusion

In today’s financial landscape, unsecured loans are thriving, thanks to a blend of factors outlined above. These loan options present borrowers with flexibility and ease, rendering them an appealing choice for those in need of swift access to funds. As the financial services landscape keeps transforming, unsecured loans are poised to maintain their crucial role in the lending sector, offering people valuable financial resources to fulfill a variety of requirements. Nevertheless, borrowers should remain vigilant and practice responsible borrowing to effectively manage their financial stability.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

- What are unsecured loans?

Loans without collateral, like a house or car, are known as unsecured loans. They are typically granted based on the borrower’s creditworthiness and ability to repay the loan, without the need for assets to secure the debt.

- How do unsecured loans differ from secured loans?

Unsecured loans differ from secured loans in that they do not require collateral. Conversely, secured loans are backed by property, such as a house or car, that the lender has the right to seize if payments are not made.

- Why are unsecured loans flourishing in the current financial scenario?

Unsecured loans are thriving due to a combination of factors, including the rise of fintech innovations, changing consumer preferences, versatile usage options, competitive interest rates, and economic uncertainties. These factors make unsecured loans a popular choice for those seeking quick and flexible access to funds.

- What are the advantages of unsecured loans for borrowers?

Unsecured loans offer borrowers flexibility, convenience, and the absence of the need for collateral. They are a quick way to secure funds for various purposes, from personal expenses to debt consolidation, without risking valuable assets.

- Are unsecured loans expected to continue flourishing in the future?

Yes, unsecured loans are likely to remain a vital component of the lending industry as the financial landscape evolves. They provide individuals with valuable financial tools to meet diverse needs. However, borrowers should be cautious and borrow responsibly to maintain their financial well-being effectively.