Field debt collections have long been a labour-intensive, time-consuming, and cost-inefficient process. Collectors often struggle with managing allocations, handling historical engagement data, navigating diverse borrower profiles, maintaining transparency in operations, and traversing widespread customer locations. Collection managers find it challenging to track the field team activities, get real-time updates on visits and transactions and identify incorrect reportings. However, advancements in technology are now transforming the field debt collections and loan resolution landscape. Credgenics CG Collect, an AI-powered solution for field collectors and collection managers, is at the forefront of this digital evolution.

In this blog, we will talk about how CG Collect is digitally transforming loan collections and debt resolution. We’ll discuss the challenges facing the industry, examine the features and benefits of CG Collect, and highlight real-world success stories demonstrating its impact.

Challenges in field debt collections

Field debt collections is loaded with challenges that make it a complex and often daunting task:

- Geographical Constraints: Field collectors need to cover large areas, making it difficult to track activities in real-time.

- Manual Processes: Traditional methods rely heavily on paper-based documentation, leading to gaps and a higher risk of errors.

- Inconsistent Communication: Ensuring consistent and effective communication with borrowers across different regions and languages is a significant hurdle.

- Data Management: Handling vast amounts of data manually can result in inaccuracies, making decision-making difficult.

These challenges underscore the need for a robust, digital solution that can streamline operations, enhance productivity, and improve outcomes. Digital solutions, particularly App for collections, are revolutionizing this space. Credgenics CG Collect mobile app is at the forefront of this transformation.

Introduction to CG Collect: A transformative solution

CG Collect—a transformative App for collections leverages cutting-edge technologies to provide actionable insights, streamline operations, and ensure compliance. CG Collect is a comprehensive solution designed to meet the evolving needs of loan collection teams and lenders. By integrating AI and ML technologies, CG Collect offers unparalleled capabilities that drive efficiency, accuracy, and productivity in debt recovery efforts.

Don’t miss out on the insights that could redefine your approach to loan collections. Watch the video and discover why CG Collect is a must-have in today’s digital age!

The evolution of debt collection practices

Debt collections have come a long way from its basic origins, where collectors relied on door-to-door visits, phone calls, and extensive paperwork. These methods, though effective to a degree, were often time-consuming, prone to human error, and lacked the ability to scale effectively with growing portfolios.

As the financial services landscape evolved, the limitations of traditional debt collections became more apparent. The rise of digital platforms and the increasing reliance on data-driven decision-making highlighted the inefficiencies of manual processes. Digital transformation in field loan collections and debt resolution is no longer a luxury but a necessity, as highlighted in numerous industry reports.

Recommended Read: Mastering Field Debt Collections – A Comprehensive Guide

How CG Collect empowers loan collections

Real-time tracking of team activities

With CG Collect, lenders and collection managers can track the activities of their field teams in real-time. CG Collect not only delivers greater operational transparency in field debt collections but also enables managers to make informed decisions quickly, leading to better outcomes.

AI-powered insights ad decision-making

CG Collect stands out for its ability to harness AI and ML to provide real-time insights that inform decision-making. By analyzing historical data and current trends, CG Collect can predict borrower behavior, prioritize tasks, and optimize the performance of field collectors.

Digital documentation and paperless processes

Gone are the days of cumbersome paperwork. CG Collect digitizes the entire documentation process, ensuring that all records are accurate, easily accessible, and securely stored. This shift to a paperless process significantly reduces the risk of errors and enhances operational efficiency.

Borrower communication and follow-up management

Effective communication is critical in debt recovery. CG Collect offers robust tools for managing borrower interactions, ensuring that communication is consistent, timely, and tailored to the borrower’s profile. To delve deeper into how CG Collect enhances borrower communication and follow-up management, explore the comprehensive details in this brochure.

How CG Collect benefits loan collection teams

Improved efficiency and productivity

By automating routine tasks and providing AI-driven insights, CG Collect enables field collectors to focus on high-impact activities. This increase in efficiency directly translates to better productivity and higher recovery rates.

Enhanced decision-making with ML insights

CG Collect’s machine learning capabilities ensure that field collectors and managers are equipped with the best possible data to make informed decisions. Whether it’s deciding the best time to contact a borrower or determining the most effective follow-up strategy, CG Collect’s insights are invaluable.

Optimal route planning

CG Collect provides field collectors with the most efficient route plan based on customer locations, minimizing travel time and boosting productivity.

Reduced manual errors and increased accuracy

The automation of processes reduces the likelihood of human error, ensuring that all data captured is accurate and up-to-date. This not only improves compliance but also enhances the overall effectiveness of debt collection efforts.

Effective management of workload for collection team

With CG Collect, field collectors can manage their workloads more effectively, reducing stress and improving work-life balance. By eliminating the need for manual data entry and streamlining tasks, field collectors can achieve more in less time.

Simplified visit scheduling

Collectors can quickly schedule PTP or field collection visits using CG Collect, with seamless Google Maps integration for easy borrower location access.

Streamlined multi-loan deposits

Field collectors can easily deposit collection amounts for multiple loans at nearby branches, Airtel stores, or banks, with recovery status marked as partial or full, enhancing efficiency.

Learn how CG Collect enables cash drop services at Airtel stores for faster field collections

Multilingual app support

They can choose from over 22 Indian languages, Bahasa, or Vietnamese for the app interface, ensuring seamless usability regardless of language preferences.

Streamlined recoveries

CG Collect simplifies loan recoveries by equipping agents with real-time access to key loan details such as DPD values, allocation months, and borrower proximity. Now with UPI Collect, it simplifies digital payments for retail borrowers, allowing quick and accurate transactions through their preferred UPI platforms.

Discover how CG Collect is transforming field debt collections through UPI

Enhanced navigation with Google Maps

Field collectors can access borrower locations via Google Maps directly within the app, ensuring accurate navigation and reducing manual effort during field visits.

Real-time geo-tracking and geo-fencing

CG Collect enables precise geo-tracking and geo-fencing of agent locations, improving field visibility and ensuring operational control.

Offline task management

With offline mode, field collectors can update their tasks even without internet access, preventing poor connectivity from affecting collections or productivity.

Learn how Credgenics StarTrack can enhance your debt recovery efforts with precise tracking and insights-driven performance management to boost field collector productivity. Explore the details in this one-pager PDF.

Reshaping rural debt collections: CG Collect in action

Credgenics is reshaping field debt collections in rural areas through the CG Collect app. Designed to tackle the unique obstacles faced by field collectors, this innovative solution empowers them with:

- Offline functionality

- Real-time geo-tagging

- Instant digital receipts

- Secure cash drop service

The technology behind CG Collect

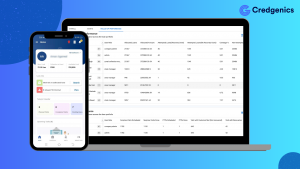

Mobile app architecture and user interface

CG Collect’s mobile app is designed with user experience in mind. The intuitive interface ensures that field collectors can easily navigate the app, access the information they need, and perform their tasks efficiently.

Discover how Credgenics CG Collect, with multilingual support, can transform field operations in this insightful video.

Overview of AI and ML algorithms used

At the heart of CG Collect is a sophisticated AI and ML engine that powers its decision-making capabilities. The algorithms are designed to analyze large datasets, identify patterns, and provide actionable insights that improve debt recovery strategies.

Data security and compliance measures

Data security is a top priority for CG Collect. The platform employs advanced encryption and compliance measures to ensure that all data is secure and that the platform meets industry standards for data protection.

Implementation and Integration

Easy onboarding process

CG Collect is designed for ease of use, with a straightforward onboarding process that allows collection teams to start using the platform quickly and efficiently.

Integration with existing systems

The platform is highly flexible, allowing for seamless integration with existing systems. This ensures that lenders and collection agencies can incorporate CG Collect into their operations without disrupting their existing workflows.

Training and support for collection teams

Credgenics offers comprehensive training and support to ensure that field collectors and managers can fully leverage the platform’s capabilities. This includes ongoing support to address any issues and help teams continuously improve their operations.

Real-World impact: Success stories

CG Collect has already made a significant impact in the field debt collections industry, with numerous success stories from leading lenders and collections agencies. These case studies highlight the platform’s ability to improve recovery rates, reduce costs, and enhance operational efficiency.

Lenders using CG Collect have reported substantial improvements in key performance indicators such as recovery rates, operational efficiency, and return on investment (ROI). These metrics underscore the platform’s effectiveness and the value it brings to the industry.

Don’t miss out—Read this Case Study to learn how CG Collect can transform your approach!

This case study explores how a leading NeoBank leveraged CG Collect, an advanced AI-powered field loan collections platform, to significantly improve their loan recovery processes. By implementing CG Collect, the financial institution achieved higher recovery rates, streamlined their collections strategies, and enhanced customer satisfaction. The platform’s automated workflows, real-time analytics, and personalized communication strategies enabled the NeoBank to manage their collections more effectively.

Unlock the full story behind IREP Credit Capital’s success—Watch the video!

Discover how Credgenics CG Collect enabled 50% higher field visits for IREP Credit Capital’s field collections team. By deploying CG Collect for field collectors, IREP boosted their productivity, stepped up borrower outreach, and saved operational expenses. Read the full case study to understand how IREP Credit Capital streamlined and automated its processes for the field team with Credgenics CG Collect mobile-based field debt collections platform.

The future of field debt collections with CG Collect

CG Collect is constantly evolving, with new features and enhancements in the pipeline. These updates will further enhance the platform’s capabilities, ensuring that it remains at the forefront of the business and technology evolution.

The debt collections industry is poised for significant changes, driven by technological advancements and changing borrower expectations. CG Collect is well-positioned to lead this transformation, helping lenders and collection agencies navigate the future of loan collections with confidence.

Hear from Sanju, a field collector, as he shares his game-changing field collections experience – Watch Now!

Conclusion

Credgenics CG Collect is revolutionizing loan collections with its AI-powered approach by offering a comprehensive solution that addresses the industry’s most pressing challenges. By enhancing efficiency, accuracy, and productivity, CG Collect empowers field collection teams to achieve better outcomes while improving the borrower experience. For a deeper understanding of how Credgenics can transform your debt collections process, explore the Credgenics collections platform’s capabilities in this brochure.

FAQs

1. What is CG Collect, and how does it transform field debt collections?

CG Collect is an innovative field debt collections solution by Credgenics that leverages advanced technologies like AI and ML to streamline operations, enhance productivity, and improve recovery rates. The app transforms traditional debt collection by offering real-time tracking, digital documentation, AI-powered insights, and automated decision-making, significantly reducing manual errors and increasing efficiency.

2. What challenges does CG Collect address in field debt collections?

CG Collect addresses several challenges in field debt collections, including geographical constraints, manual processes, inconsistent communication with borrowers, and difficulties in managing large volumes of data. By digitizing operations and providing real-time insights, CG Collect helps overcome these hurdles effectively.

3. How does CG Collect enhance the efficiency and productivity of field collection teams?

CG Collect automates routine tasks, provides AI-driven insights, and streamlines communication and documentation processes. This allows field collectors to focus on high-impact activities, leading to improved efficiency, higher productivity, and better recovery outcomes.

4. What are the key features of CG Collect that make it stand out?

Key features of CG Collect include real-time tracking of team activities, AI-powered insights and decision-making, digital documentation and paperless processes, and robust tools for managing borrower communication. These features collectively enhance the accuracy, efficiency, and transparency of debt recovery efforts.

5. How does CG Collect ensure data security and compliance?

CG Collect employs advanced encryption and compliance measures to secure data and ensure that the platform meets industry standards for data protection. This includes safeguarding sensitive borrower information and maintaining compliance with relevant regulations.

6. What real-world impact has CG Collect had on debt recovery efforts?

CG Collect has significantly improved key performance indicators for lenders and collection agencies, such as recovery rates, operational efficiency, and return on investment (ROI). Real-world case studies demonstrate the platform’s ability to reduce costs, enhance productivity, and improve overall debt recovery outcomes.

7. What kind of support and training does Credgenics provide for CG Collect users?

Credgenics offers comprehensive training and ongoing support to ensure that field collectors and managers can fully leverage CG Collect’s capabilities. This includes assistance during onboarding, continuous training sessions, and dedicated support to address any operational challenges.

8. How does CG Collect improve the work-life balance of field collectors?

By automating manual processes and reducing the need for extensive paperwork, CG Collect allows field collectors to manage their workloads more effectively. This reduction in time-consuming tasks leads to less stress and a better work-life balance for field collectors.

9. What future developments can we expect from CG Collect?

CG Collect is constantly evolving, with new features and enhancements planned to further improve its capabilities. These updates will ensure that the platform remains at the cutting edge of field debt collections technology, helping lenders and collection agencies navigate future challenges with confidence.