The lack of transparency in work distribution and ineffective incentive management contribute to the high attrition rates experienced by collections contact center teams and field teams. In addition to lowering team morale, this translates into subpar performance in collections.

Therefore, it is crucial for lenders to prioritize transparency and effective tracking of agent performance, which will result in higher agent satisfaction and an accurate distribution of associated incentives. By streamlining daily tasks, establishing transparency around incentive management, and establishing clear accountability, teams can perform better, and agent turnover can be decreased.

However, a major challenge lies in capturing key performance metrics, which is a time consuming and manual process for planners, including team leaders and supervisors. The key performance indicators (KPIs) for calling agents and field agents may also vary. Furthermore, lenders who outsource collections to third parties may manipulate KPI data to obtain sizable incentives from their lender clients without achieving their set targets, which makes the assessment process more difficult.

According to agent experience data gathered from Credgenics’ “CG Collect” field debt collections app, 66% of field debt collections agents failed to meet their goals because they did not understand how performance indicators and incentives were distributed. Additionally, these agents only had a 50% active range, which indicates lower agent collection efficiency.

With its new product, CG AgentXcel, Credgenics is addressing the challenges associated with agent performance management. The sophisticated solution offers thorough and precise reports of agent visits, collections, attempts, and lender-specific KPIs to analyze and improve coverage and agent satisfaction levels.

CG AgentXcel – A smart platform for performance assessment

Every collections team operates differently, so in order to make an accurate assessment, the performance objectives must be stated upfront. The agent performance platform should be easily configurable to cater to the tasks assigned to field agents and contact center agents. However, the sheer number of KPIs that are available for debt collections can be overwhelming.

So, what are the best KPIs for a supervisor to use when evaluating their debt collections processes? CG AgentXcel comes with performance evaluation frameworks that are designed to help collections team supervisors stay ahead of the curve. The feature provides real-time insights into agents’ on-ground activity and key performance indicators (KPIs) such as ‘Visit Trails Submitted’, ‘Collections Marked’, ‘POS Recovered’, ‘Calls Attempted’, and ‘Percentage Resolutions’.

Tracking agents’ behavior with a 360-degree view of activities in real-time and addressing the operational challenges results in improved performance. With a significant amount of normalized data, supervisors can evaluate teams in hours instead of weeks, with the automatic assessment workflows. They can also group agents according to certain parameters and distribute interfaces.

The easy-to-use interface of the CG platform ensures that companies can quickly and efficiently track employee performance, reducing the time and resources required for manual data collection and analysis. Moreover, having access to Credgenics’ calling and the CG Collect platform eliminates any errors and helps in the quick synchronization of agent data and speedy actions.

Stay on track with CG AgentXcel to enhance agents’ collection metrics

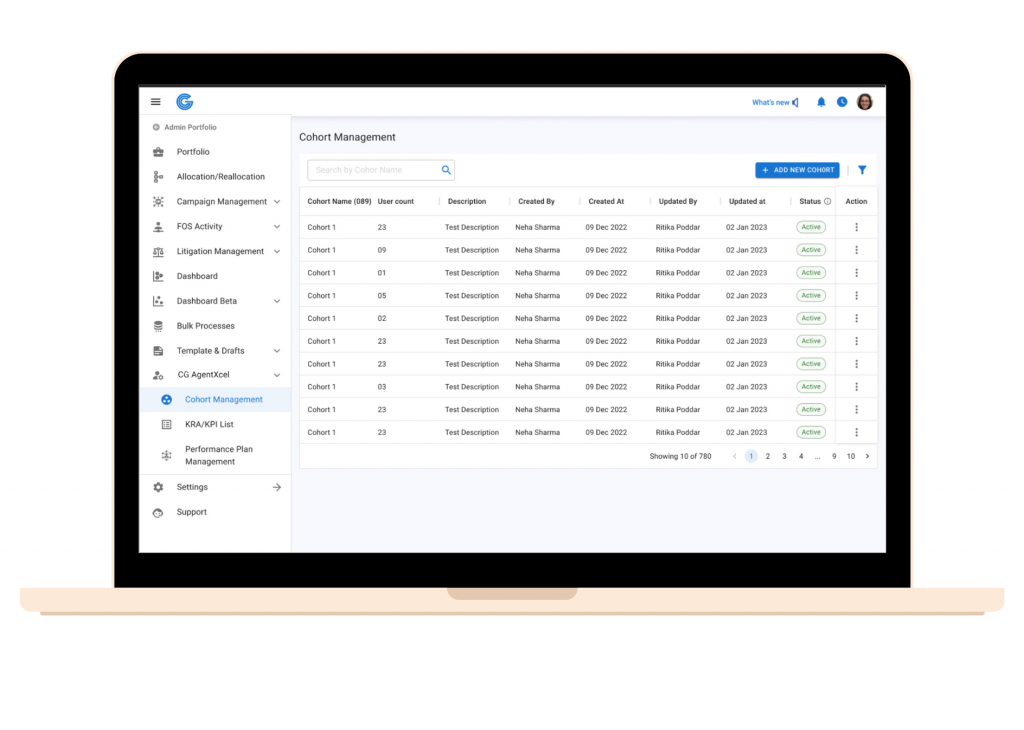

- Create Cohorts – Lenders can analyze and compare the performance of agents by creating cohorts based on criteria like profession, team, role, location, and date, which can be configured as per the lender’s requirements.

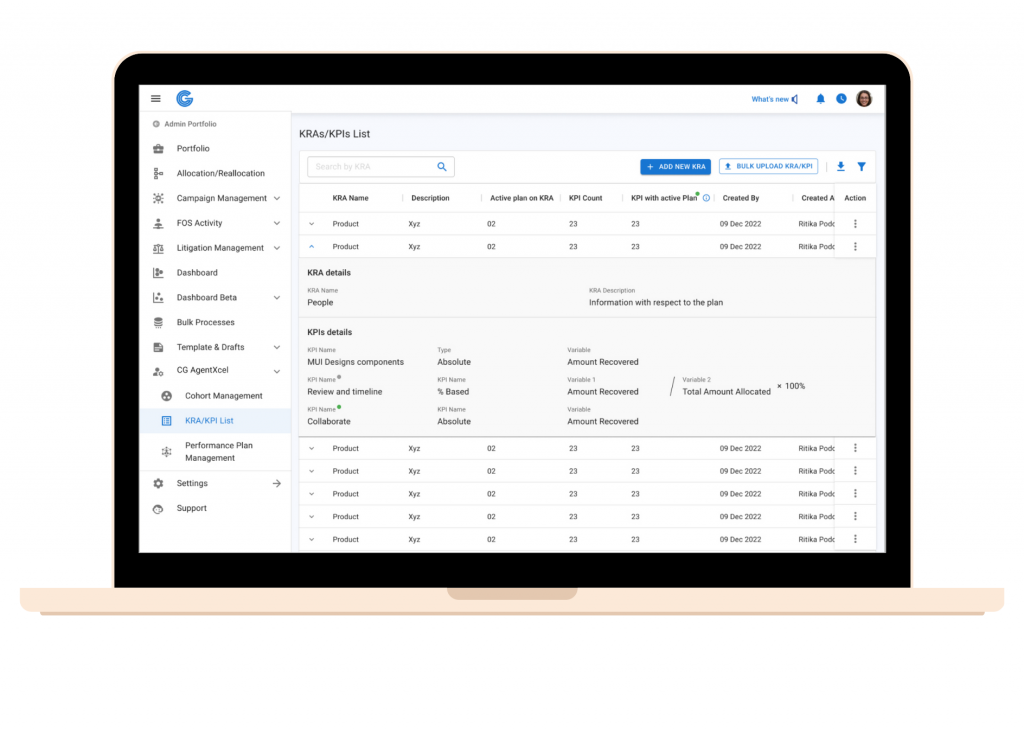

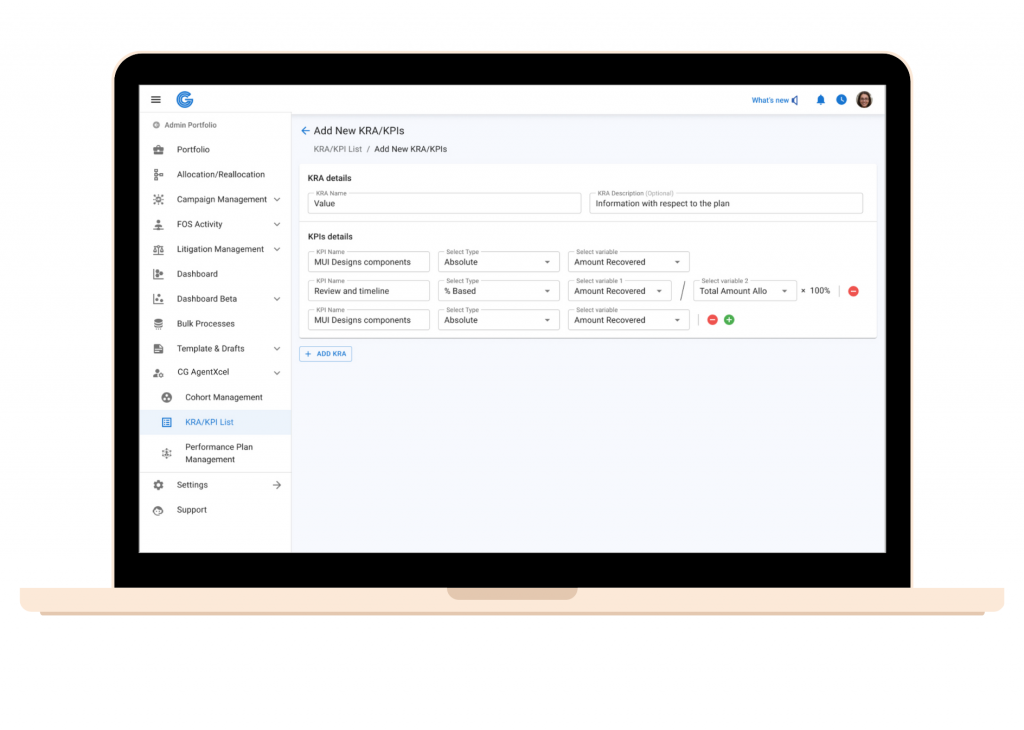

- Put team KRAs to action – The collections teams can define different KRAs / KPIs based on the team structure. KPIs are based on combinations of different performance variables of modules such as Feet-on-Street, calling, percentage recovered, and number of meetings completed. The collections team can also define the type of KRA variable, like currency, percentage, or absolute numbers, for accurate comparisons.

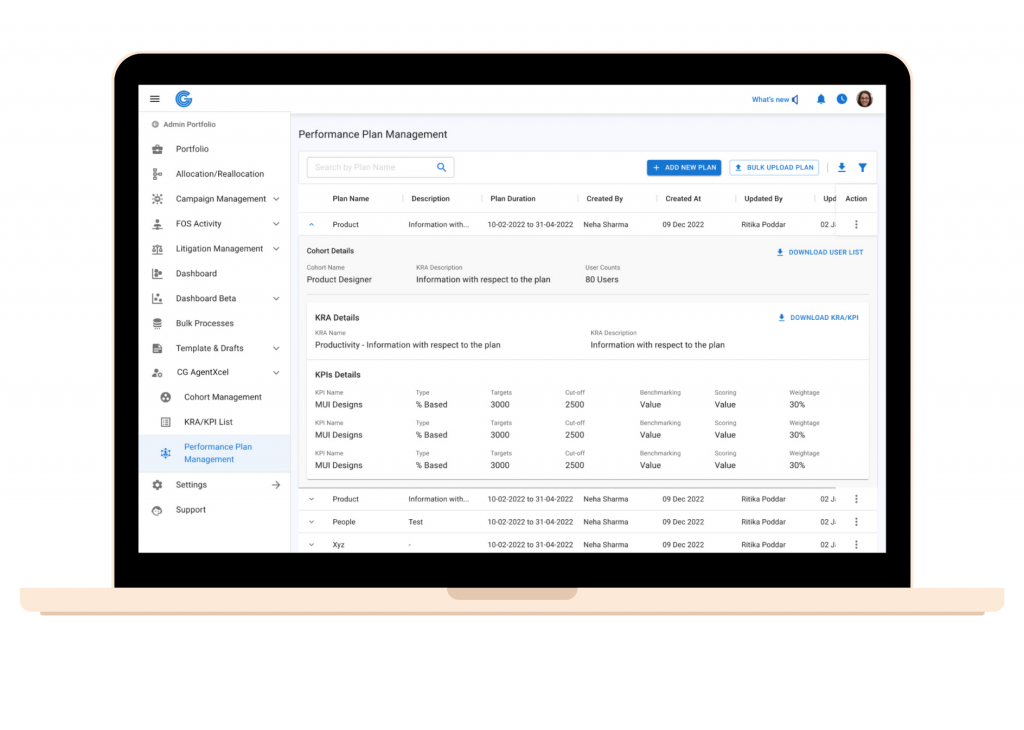

- Insights for smarter planning – Using the cohorts and KRA / KPI laundry list, one can easily create a performance plan. Companies can download the detailed reports for agents’ performance on the plans, which can streamline the analysis by bringing in important indicators in one place and help to find the true north for the team. Each KPI has targets, a cutoff, a weightage, and a scoring method. The scores are finally generated based on performance plans, which are subsequently used for agent ranking within a plan or across plans.

What gets measured gets done!

1. Improved agent experience: Agents can complete their tasks faster, with fewer errors, and with greater satisfaction. By tracking agents’ performance, supervisors can allocate loans more effectively and increase overall productivity.

2. Increased team flexibility: The availability of real-time performance data expedites decisions about resource allocation and training for better business outcomes.

3. Comprehensive incentive management: A quantitative framework for measuring and rewarding performance will establish clear performance metrics and goals and tie incentives and rewards to goal achievement.

4. Lower attrition rates: By having clear performance metrics, field agents can understand what is required to meet or exceed expectations. They are likely to feel more engaged and motivated with improved performance monitoring and ongoing feedback for improvement. This can lead to higher retention rates and lower agent turnover.

CG AgentXcel is now live on the CG platform. This platform enables lenders and their field and collections contact center teams to track performance and perform activities such as visits, submissions, deposits, and other collections activities more effectively and efficiently.

Agents and collections teams equipped with CG AgentXcel for performance management are more likely to enhance borrower satisfaction, reduce the cost to collect, and increase collections. Focusing on agent satisfaction and performance management will not only avoid significant costs, but also enable streamlined field and contact center collections operations.

Learn more about CG AgentXcel and how this module is helping collections teams automate and digitize last-mile collections.

FAQ’s

- What is CG AgentXcel Cohort offering?

This feature groups debt collections agents/teams being evaluated.

- What is KRA/KPI ?

KRA- A superset of KPIs

KPI- Metric on which debt collections agent/team is assessed.

- What is the KPI type in CG AgentXcel?

The user has two types of KPI types – Numeric and Percentage

- What is Benchmarking in CG AgentXcel?

a.Roster Based – The attendance roster has to be uploaded on the UI . Basis the

debt collections agents’ attendance the target will be calculated.

b.Target – Roster Days/ Program Duration * Total target definedj

c. Roster Independent – The target for all debt collections agents will be as

Defined.

- How is scoring done in CG AGentXcel?

a. % Achievement Basis – Depending on the weightage of the KPI and KRA, the final

achievement will be calculated on the % basis.

b. Scoring method – Depending on the slab defined, the score will be displayed