What are the challenges faced by debt collection calling agents?

Debt collections managers and contact center agents frequently encounter high abandonment rates, high borrower complaints, and low-performance efficiency when relying on manual dialing campaigns. Similarly, automated calling through auto-dialers also serves a limited purpose. Calling agents waiting for borrowers to answer calls experience low connect rates and extended idle times, resulting in decreased productivity. To address these issues, the implementation of a predictive dialer solution proves to be highly advantageous. By automating the process of dialing phone numbers and connecting them to available agents, a predictive dialer solution significantly improves the performance of teams engaged in high-volume outbound calls. This innovative system serves as an effective solution to enhance operational efficiency and optimize the outcomes of collections efforts.

What is Credgenics Predictive Dialer?

Credgenics predictive dialer solution is an advanced cloud-based calling solution that enables debt collection teams and collection agencies to significantly improve the efficiency and productivity of their borrower calling operations. It is a powerful technology platform that automates the process of dialing borrower’s phone numbers and detects line busy signals and disconnected numbers. As a result, only calls answered by borrowers are connected with agents, ensuring optimal resource utilization. This also eliminates the requirement for agents to manually dial phone numbers and persistently attempt calls until they are answered, thereby saving valuable time and effort.

With its AI-powered capabilities for dialing models, Credgenics Predictive Dialer Solution improves the call connection rate. Customers who have used Credgenics Predictive Dialer solution have seen a 5X increase in call connection rates*. The performance of calling teams has also increased significantly, and they are able to connect with distressed customers faster and more efficiently.

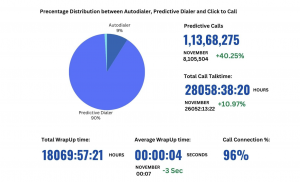

Fig 1: Credgenics Predictive Dialer Solutions’ performance numbers for Dec 2023

Connection rate refers to the percentage of calls that are answered by customers.

Credgenics Predictive Dialer Solution includes the following features:

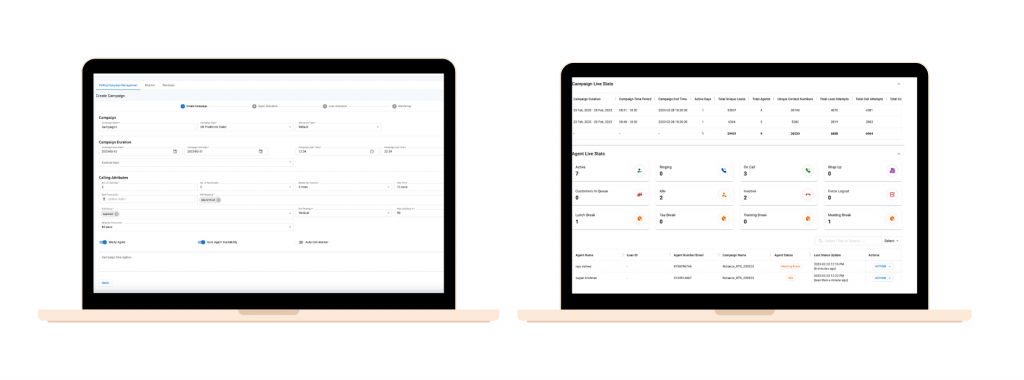

- Call recording enables team supervisors to listen in on agent calls to ensure that they are following company protocols and providing the required level of customer service.

- Call monitoring allows team supervisors to listen in on live calls and assist agents as needed.

- Real-time reporting provides team supervisors with detailed and actionable insights into the performance of agents, including the number of calls made, the duration of calls, and the success rate.

Fig 2: Credgenics Predictive Dialer Solution dashboard

How does Credgenics Predictive Dialer Solution improve calling agent productivity with AI?

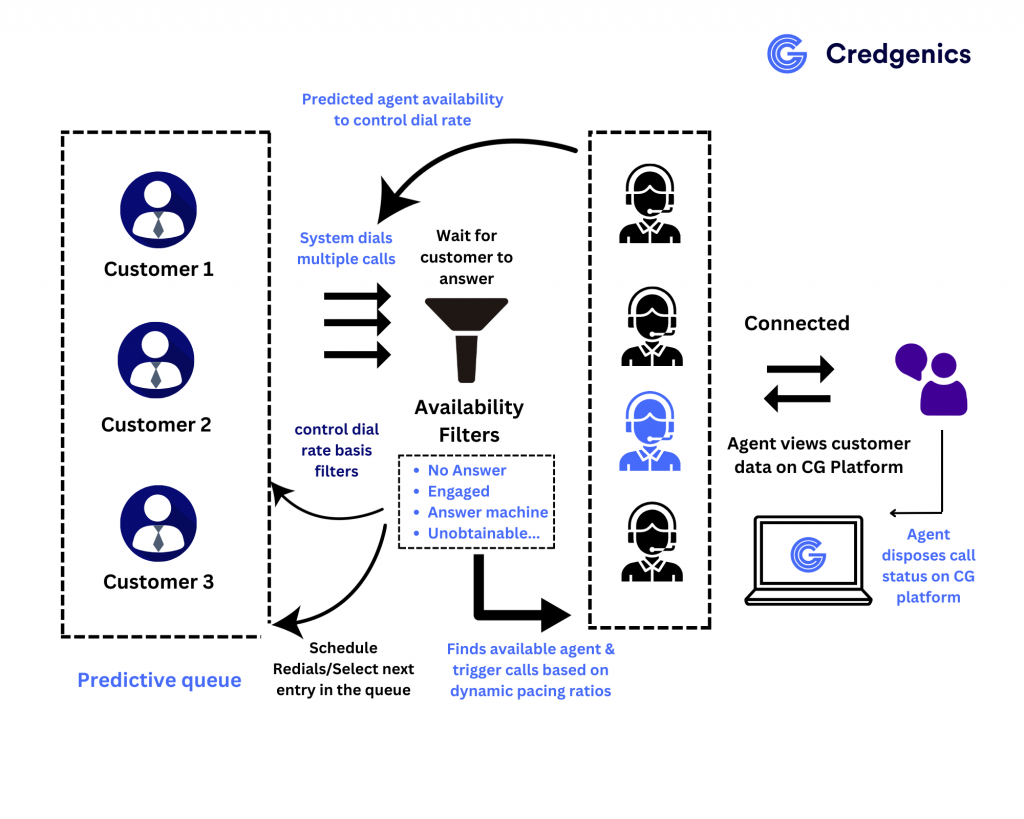

By using advanced AI algorithms to determine the optimal time to call each loan borrower, Credgenics Predictive Dialer System ensures that agents can reach the highest number of borrowers in the least time, while minimizing the number of unanswered calls, hang-ups, and increasing RPCs. The predictive dialer software also determines the number of calls to be triggered per available agent, which can be set by the supervisor, and the dialer will automatically adjust it based on the call pick up rate at the time. The solution ensures that the calling agent always has a call to attend to, reducing their idle time.

Credgenics Predictive Dialer Solution automatically screens out unproductive calls, such as answering machines, busy signals, and disconnected numbers. Agents can focus their time and energy on calls that are most likely to result in positive outcomes, leading to a higher percentage of successful debt collections.

Credgenics Predictive Dialer Solution offers strict compliance with regulatory requirements. The solution automatically removes closed loans and manages Do-Not-Dial (DND) registered contacts to reduce borrower escalations and unnecessary calling attempts.

What makes Credgenics Predictive Dialer unique for debt collections?

Credgenics Predictive Dialer comes integrated with CG platform modules like the CG Collect Field Collections app, the Litigation Management System, and Billzy Payments. The API based integration enables seamless communication between systems and facilitates data-exchange in real-time. Credgenics Predictive Dialer routes calls to available agents and tracks the status of each call in real time, such as whether it was answered, went to voicemail, or was busy. Seamless access to the necessary information from other modules, such as the list of accounts to call and the call disposition codes to use for each account, simplifies and optimizes the telecalling efforts.

How is Credgenics Predictive Dialer Solution improving collections operations?

Credgenics Predictive Dialer Solution is an essential platform for any debt collections team, collections agency, or legal firm looking to maximize the productivity and profitability of its calling function. With its powerful features, Credgenics Predictive Dialer system enables calling agents to make more calls at higher efficiencies and achieve better connection rates.

If you are looking for an advanced, reliable, and efficient predictive dialer software, contact us at sales@credgenics.com.

FAQ’s

Q1) What is the difference between predictive dialer and auto dialer?

While an autodialer places automated calls to a predefined list of contacts, a predictive dialer uses AI-powered algorithms to initiate outbound calls a few seconds before an agent completes their previous call, thereby saving valuable time. Auto dialers are generally suitable for smaller teams and optimize queue times by calling the entire contact list. In contrast, predictive dialers help place more calls by optimizing the timing of calls based on agent availability, calling patterns, and answer patterns.

Q2) Why do debt collectors use predictive dialers?

Predictive dialers serve as a valuable tool for debt collectors due to their efficiency in reaching multiple borrowers. These dialers initiate multiple calls simultaneously but only connect the answered calls to available agents. They employ advanced AI-powered algorithms to predict agent availability and estimate the time it takes for a borrower to answer.

In the context of larger teams, predictive dialers ensure that agents handling all the calls can reach out to borrower prospects more swiftly and effectively.

Technical FAQ’s

| What is the difference between active and idle agent | Active agent means the agent is active and doing his work while Idle agent is one who is not active but still shown online on the platform |

| What is a manual call in Predictive Dialer solution? | Manual calls are the ones in which the agent has to manually type customer’s number in a dialpad but manual call will only be done if the agent is on a break |

| How to calculate Pacing Ratio? | Pacing Ratio can be calculated by using Max drop percentage. Example, if Max drop percentage is 0.5, then by using the formula (1 / 1 – Max drop percentage), Pacing will be 2 then the Pacing Ratio will be 1:2 |

| What is meant by Wait Time in Predictive Dialer Software? | It is the maximum time gap in seconds between the agent wrapping up the previous call, and being connected to a fresh call. |

| What is the optimum number of channels required for predictive dialing? | You require 1.25 channels per agent on a minimum basis to run predictive dialer campaigns. Ideally, a ratio of 2:1 (2 channels per agent) is best to run predictive dialer campaigns. |

| What are Connected Calls? | The calls that are connected(ringing done) from both agent and customer side. |

| What are Answered Calls? | The calls which customers pick-up from their end. |

| What are Failed Calls? | The calls that are not connected because of some reasons like switch off, wrong numbers, and blocked calls. |

| What are Missed Calls? | Missed calls are those in which the customer is on call but the agent missed the call and is available. |

| What is an Abandoned Call? | Abandoned calls are those in which a customer is on call but the agent is not available. |

| What is the Max Call Drop percentage? | Max Call Drop percentage is the maximum percentage of call drops allowed, out of the total number of connected outgoing calls. |

| What is Pacing Ratio? | The pacing ratio is the number of calls that the dialer can make for each agent. For example, if the pacing ratio is 1:3, it means for a single agent 3 calls will be dialed out at the same time. |

| What is the relationship between Pacing Ratio and Max Call Drop percentage? | The pacing ratio is defined by the formula (1 / 1 – Max Call Drop percentage) |

| What is the dialing ratio? | It is defined as the number of calls the dialer dials in a unit time depending on the number of available agents. |