Asset recovery is vital for banks and other financial services companies, but it faces challenges like inefficient processes, disconnected workflows, poor tracking, and regulatory compliance issues. Improving asset recovery is essential for maintaining financial health and reducing bad loans in the competitive lending world.

To help lenders address these challenges, Credgenics introduces Repossession Management Solution, a cutting-edge solution designed for transforming asset recovery. The solution offers an innovative approach to digitize and enhance repossession processes. This innovative platform ensures that recovery operations are faster, cost-effective, and compliant. By combining real-time data analysis and automation, Credgenics’ solution significantly reduces recovery times and operational costs.

Let’s explore how this technology solution is transforming asset recovery, providing lenders with a powerful tool to enhance efficiency, compliance, and overall repossession management.

What is repossession?

Before we explore the solution, let’s briefly understand repossession. Repossession is a process that occurs when a customer defaults on a loan secured by collateral, leading the lender to seize the asset used to secure the loan. This collateral can be any physical or financial asset pledged by the borrower to guarantee the loan repayment.

The most commonly repossessed items are vehicles, such as 4 wheelers and 2 wheelers. Essentially, if a loan customer fails to fulfil their repayment obligations, the lender has the legal right to take possession of the collateral to recover the owed amount.

Repossession is typically outlined in the loan agreement, where it is stipulated that the lender can take control of the collateral if the borrower defaults. This serves as a form of protection for the lender, ensuring that they have a means to recover their funds if the borrower cannot meet their repayment terms. To facilitate this process, many lenders employ a repossession management service to handle the complexities of asset recovery.

The asset recovery challenge

Effective asset recovery is essential to preserving financial stability within the lending ecosystem. However, traditional recovery methods often fail to meet the mark, resulting in significant challenges:

- Inaccurate Records: Gaps in data leads to wasted work.

- High Operational Costs: Escalating expenses eat into profits.

- Slow Completion Times: Lengthy processes that delay financial recovery.

- Lack of Real-Time Visibility: Unable to monitor and respond quickly.

- Ineffective Asset Tracking: Difficulty in locating and securing assets.

These issues not only hinder timely recoveries but also amplify losses and elevate compliance risks for lenders, undermining the overall health of the financial system.

Credgenics Repossession Management: Simplifying asset recovery for lenders

Credgenics Repossession Management solution effectively addresses these pain points. By digitizing and streamlining the entire repossession process, it’s setting a new standard for operational efficiency and compliance in asset recovery.

Comprehensive features for enhanced asset recovery:

1. All-in-one Platform: Credgenics offers a comprehensive solution for all repossession needs, from initiation to asset control. The platform streamlines the entire asset recovery process, transforming it into a simplified digital workflow. This digitization eliminates manual errors, ensures real-time updates, and enhances transparency.

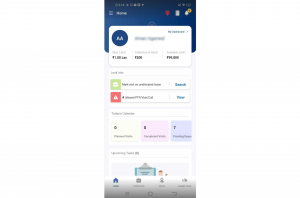

2. Field Force Integration: By integrating field collection teams into the repossession workflow, Credgenics leverages their expertise for efficient asset recovery. Credgenics’ Feet-on-Street mobile app empowers field collectors to execute repossession tasks efficiently and provide real-time status updates.

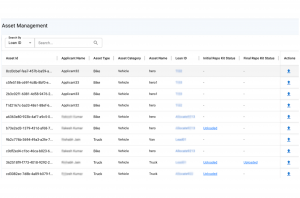

3. Centralized tracking and management: One of the standout features of Credgenics Repossession Management is its centralized platform. Lenders can initiate, track, and monitor repossession activities from a single interface. This centralization not only simplifies the management of multiple cases but also provides comprehensive visibility into each step of the repossession journey. From initial eligibility assessment to physical recovery and stockyard submission, every action is meticulously tracked.

4. Streamlined Workflow: The comprehensive system manages the complete journey of assets eligible for repossession. It begins with the initial assessment and verification, moves through the physical recovery of the asset, and concludes with its warehousing and stockyard submission. This structured workflow ensures that every step is executed promptly, reducing delays and operational bottlenecks.

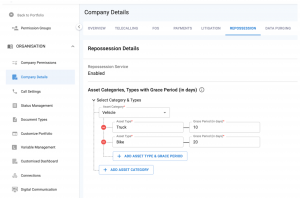

5. Legal Compliance and Risk Mitigation: The solution is designed to align with relevant legal and compliance requirements for reducing risks for lenders. Credgenics ensures that all actions within the repossession process adhere to the regulatory requirements. This compliance is critical for avoiding legal consequences and maintaining the lender’s reputation.

6. Pre-configured Documentation and Efficient Disposal: Credgenics provides pre-configured documentation and streamlined processes for the efficient disposal of recovered assets. This feature reduces administrative burdens and ensures that all necessary paperwork is completed accurately and swiftly.

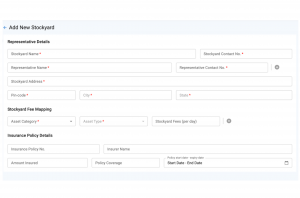

7. Stockyard Management: The solution includes features for efficient handling and tracking of recovered assets in stockyards. This ensures that assets are stored safely and can be accessed or disposed of as needed, further enhancing operational efficiency.

Recommended Read: How CG Collect is transforming field debt collections through UPI

The repossession workflow simplified

Credgenics has transformed the repossession process into a streamlined, five-step workflow:

1. Initiate repossession for eligible loan accounts

2. Allocate cases to field teams with detailed information

3. Track repossession activities, including documentation and asset tracking

4. Select the appropriate stockyard from a list

5. Complete the asset recovery process

This simplified approach ensures that every step of the repossession journey is accounted for and optimized.

Benefits for lenders

By adopting Credgenics Repossession Management solution, lenders can expect:

- Improved Efficiency: Digitization speeds up the entire process, from initiation to asset recovery.

- Real-time Visibility: Lenders gain instant insights into repossession activities, enabling better decision-making.

- Cost Reduction: Streamlined processes and improved efficiency lead to lower operational costs.

- Enhanced Compliance: The system ensures adherence to regulatory and organizational policy requirements.

- Faster Asset Recovery: Timely repossession mitigates the risk of further asset damage or loss.

- Better Portfolio Health: Efficient asset recovery contributes to a healthier loan portfolio for lenders.

Use Case: Enhancing asset recovery in auto lending

Background

ABC Auto Finance, a leading auto financing company, faced significant challenges in managing its repossession process. With a large portfolio of car loans and increasing defaults, the company struggled with inefficiencies, high operational costs, and suboptimal asset recovery rates. To address these issues, they implemented the Credgenics Repossession Management solution.

Implementation

ABC Auto Finance optimized its repossession workflow by adopting Credgenics’ platform, including:

- CG Collect mobile app for field agents

- Centralized dashboard for real-time monitoring

- End-to-end digital transformation of the repossession process

- Automated flagging of defaulting account

- Efficient asset disposal system

Results:

- Ensured regulatory compliance

- Delivered analytical insights into borrower behavior

- Maintained seamless communication throughout the repossession journey

- Enhanced operational efficiency, visibility, and control

- Improved management of non-performing assets in the auto loan portfolio

This implementation equipped agents with mobile technology for real-time updates and documentation, significantly boosting ABC Auto Finance’s repossession process effectiveness.

The future of asset recovery

As the lending landscape continues to evolve, solutions like Credgenics’ Repossession Management will play a crucial role in maintaining financial stability. By leveraging technology to simplify complex processes, ensure compliance, and improve efficiency, Credgenics is not just solving today’s problems – it’s paving the way for a more resilient and effective lending ecosystem.

In a world where every asset counts, Credgenics is empowering lenders to recover with confidence, speed, and precision. It’s not just about getting assets back; it’s about doing it in a way that’s smarter, faster, and more compliant than ever before.

Are you ready to transform your asset recovery process? Discover how Credgenics can help you navigate the complexities of repossession and drive your lending business forward.

FAQ:

1. What is Credgenics Repossession Management?

Credgenics Repossession Management is an advanced solution designed to enhance asset recovery for lenders, including banks, non-banking financial companies (NBFCs), and fintech firms. It leverages cutting-edge technologies combined with a digital-first approach, data-driven insights, and a focus on dignity to streamline repossession processes. This comprehensive platform makes asset recovery services faster, more efficient, and fully compliant with regulatory requirements.

2. How does Credgenics Repossession Management improve asset recovery?

Credgenics improves asset recovery by offering a comprehensive platform that integrates real-time data analysis and automation. This reduces recovery times, lowers operational costs, and ensures compliance with legal and regulatory requirements. Key features include centralized tracking, field force integration, and efficient stockyard management.

3. What challenges does Credgenics Repossession Management address?

Credgenics addresses several challenges in traditional asset recovery methods, such as inaccurate records, high operational costs, slow completion times, lack of real-time visibility, and ineffective asset tracking. By digitizing and streamlining the entire process, Credgenics enhances efficiency and compliance.

4. What are the benefits of using Credgenics Repossession Management for lenders?

Lenders using Credgenics Repossession Management can expect improved efficiency, real-time visibility into repossession activities, cost reduction, enhanced compliance, faster asset recovery, and better portfolio health. The system’s digital workflow ensures timely and accurate recovery of assets.

5. How does Credgenics ensure legal compliance during repossession?

Credgenics ensures legal compliance by aligning all actions within the repossession process with relevant legal and regulatory requirements. This reduces the risk of legal consequences and helps maintain the lender’s reputation. The solution also provides pre-configured documentation to streamline the compliance process.

6. Can Credgenics Repossession Management be integrated with field collection teams?

Yes, Credgenics integrates with field collection teams through its Feet-on-Street mobile app. This app empowers field collectors to execute repossession tasks efficiently and provide real-time status updates, enhancing the overall effectiveness of the asset recovery process.