Debt collections play a crucial role in driving healthy growth of the lending industry, enabling financial institutions to recover outstanding payments owed by borrowers. It serves as the mechanism through which repayments are retrieved, ensuring the sustainability of financial operations and maintaining a healthy economic ecosystem.

However, managing collections in-house can be a daunting and resource-intensive task, often requiring specialized expertise and infrastructure. This is where Collection as a Service (CaaS) emerges as a thoughtful solution, empowering lenders to streamline their collection processes while leveraging the expertise and resources of specialized service providers.

The debt collection market in India is massive, worth Rs 40,000 crores, and growing at an impressive 18% annually. Yet, it faces major hurdles like slow processes, traditional collection methods, and poor grievance handling. CaaS solutions address these challenges by leveraging advanced technologies, ethical practices, and customer-centric approaches to optimize the debt collection process while maintaining high standards of compliance and customer satisfaction.

In this comprehensive guide, we discover the mechanics behind CaaS, its myriad benefits, and how it empowers lenders to streamline operations and optimize debt recovery strategies.

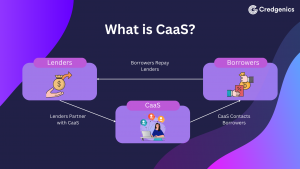

What is Collection as a Service (CaaS)?

Collection as a Service (CaaS) is a comprehensive solution that enables lenders to outsource their debt collection processes to specialized third-party service providers or leverage their advanced platforms. These CaaS providers offer a range of services and cutting-edge technologies designed to optimize the debt recovery process, ensuring efficient, compliant, and customer-centric approaches.

At their core, CaaS solutions include tasks such as sending automated reminders and notifications, contacting debtors through various channels (phone, SMS, email, WhatsApp), negotiating payment plans, following up on delinquent accounts, and ensuring compliance with relevant debt collection regulations.

How does Collection as a Service (CaaS) work?

Collection as a Service (CaaS) providers act as strategic partners in the debt collection ecosystem, taking on responsibility for various aspects of the collections process. Their core functionalities can be summarized as follows:

- Multi-Channel Communication: CaaS platforms employ multiple communication channels, including SMS, emails, phone calls, WhatsApp, voicebots, chatbots, and IVRs to reach out to debtors. This allows for a personalized approach based on individual preferences.

- Automated Workflows: CaaS utilizes technology to smartly automate repetitive tasks like sending reminders and notifications to borrowers. This streamlines the process, saving significant time and resources.

- Payment Facilitation: From negotiating payment plans to following up on delinquent accounts, CaaS providers manage the entire payment retrieval process with diligence and professionalism.

- Data Analytics and Reporting: CaaS platforms leverage advanced data analysis to understand customer behavior and payment trends. This insight allows for the development of targeted collections strategies for maximum efficiency.

- Compliance Expertise: CaaS providers ensure strict adherence to all relevant debt collections regulations, protecting both lenders and borrowers from legal issues.

CaaS serves as a catalyst for optimizing the collections workflow, ensuring efficient debt recovery while nurturing positive lender-borrower relationships. Behind the scenes, it employs cutting-edge data analytics to gain deep insights into customer behavior and payment trends. This data-driven approach informs targeted collections strategies, maximizing efficiency and recovery rates. Most importantly, CaaS ensures strict adherence to all relevant debt collection regulations, safeguarding lending companies from legal pitfalls.

Recommended Read: How Automation Can Maximize Loan Recovery

Benefits of Collection as a Service (CaaS) for Debt Collections

By using CaaS, lenders gain numerous benefits, including:

1) Improved Borrower Experience: With clear communication, flexible payment options, and professional interactions, the experience for borrowers is enhanced, reducing stress and fostering positive relationships.

2) Reduced Cost: Eliminating the need for in-house collections staff and associated infrastructure expenses.

Streamlined Operations: Automate tasks and free up valuable internal resources, resulting in streamlined operations and increased efficiency.

3) Increased Efficiency: Leverage automation capabilities and technology integration offered by CaaS providers to enhance efficiency and expedite debt recovery.

4) Enhanced Recovery Rates: Experience faster and more efficient debt collections processes that utilize effective strategies and tools, resulting in the swift recovery of outstanding funds.

5) Reduced Turnaround Times: From initial contact to final resolution, every step of the debt collections process is optimized for speed and efficiency, ensuring that outstanding debts are addressed promptly and effectively.

6) Enhanced Compliance: CaaS providers adhere to complex debt collections regulations, ensuring legal compliance.

Recommended Read: Enhancing Debt Collections with Credgenics’ Post-Call Communications Strategy for Dialers.

How Lenders Can Leverage Collection as a Service (CaaS)

Effective Communication

- Omnichannel Reach-Out: Engage borrowers through various channels with multi-lingual support for enhanced accessibility.

- Digital Communication Accessibility: Utilize digital communication platforms like SMS, IVR, Chatbot, and Whatsapp to connect with borrowers efficiently.

- End-to-End Activity Tracking: Monitor and track loan account activities and borrower interactions comprehensively for better insights.

Informed Decision-making

- Rule-Based Strategies: Develop communication strategies based on predefined rules and data-driven insights to optimize borrower interactions.

- Case Prioritization: Prioritize cases based on the likelihood of repayment to focus efforts effectively.

Legal Automation

- Notice Dispatching: Automating the dispatching of physical and digital legal notices while digitally tracking litigation progress.

- Digital Case Repository: Maintain a digital repository of all legal cases for easy access and management.

- Legal Notice Sending and Tracking: Streamline the process of sending and tracking legal notices for efficient legal proceedings.

Mediation and Arbitration Support

- End-to-End Proceedings: Facilitate traditional and digital proceedings for mediation/ conciliation and arbitration seamlessly.

- Online Dispute Resolution: Provide faster resolutions with online services through empaneled case managers, arbitrators, neutrals, and mediators.

How to Choose the Right CaaS Provider?

When selecting a Collection as a Service (CaaS) provider, it’s crucial to consider the following factors:

- Proven Track Record and Industry Reputation: Look for providers with a solid history and positive reputation in the debt collections industry. Their experience can be a testament to their reliability and expertise in handling collections processes professionally and ethically.

- Comprehensive Service Offerings and Scalability: Assess the range of services that the provider offers to ensure that they align with your specific business needs. Additionally, consider their ability to scale their services seamlessly as your business grows or your collection requirements evolve.

- Robust Technology Infrastructure and Data Security: Evaluate the provider’s technology infrastructure and data security measures. Ensure they have robust systems in place to safeguard sensitive financial and personal information, protecting against potential cybersecurity threats and data breaches.

- Regulatory Compliance and Ethical Practices: Verify that the provider complies with all relevant regulations, such as the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, maintaining ethical debt collections practices and avoiding potential legal issues.

- Transparent Pricing and Fee Structure: Thoroughly understanding the provider’s pricing structure and fee model. Look for transparency in their fees to avoid any unexpected costs or hidden expenses.

Furthermore, clear communication and well-defined contract terms are essential when selecting a CaaS provider. Open and transparent communication ensures mutual understanding of expectations, requirements, and responsibilities.

Recommended Read: Adapting to the Latest Regulation Changes in Fintech

In Conclusion

Collection as a Service (CaaS) offers a promising solution for lenders struggling with the intricate challenges of debt collections. By collaborating with CaaS providers, lending companies, NBFCs, and other financial institutions can streamline their collections process, leading to improved cash flow, reduced costs, and a more positive experience for borrowers.

Key Takeaways:

- CaaS facilitates better recovery rates and huge operational cost savings for lenders.

- The expertise and cutting-edge technology offered by CaaS providers help optimize the collections experience for all parties involved.

- Borrowers can expect smoother and dignified collections processes that foster better relationships with lenders.

While CaaS offers numerous advantages, it’s crucial to address potential concerns, such as data security and privacy. Despite these considerations, the overall value proposition of CaaS remains compelling. With its ability to enhance efficiency, improve operations, and nurture positive borrower relationships, CaaS emerges as a valuable tool for lenders and allied businesses.

Transform Your Debt Collections with Credgenics

As a leading digital collections and debt resolution solutions provider, Credgenics empowers lenders to transform their debt collections processes through advanced AI/ML technologies, data analytics, and industry best practices. Our tech-led SaaS platform, streamlines the collections journey with automated communication systems, smart reporting and analytics tools, and specialized collections team, enhancing efficiency and effectiveness for superior debt recovery outcomes. Adopt modern collection methods that are future-ready with Credgenics’ data-driven collection strategies.

Collection as a Service (CaaS) FAQs

What is CaaS?

Collection as a Service (CaaS) refers to outsourcing the debt collection process, or specific parts of it to specialized third-party service providers. These platforms leverage advanced technologies, data analytics, and industry best practices to optimize the debt recovery process.

What are the benefits of using Collection as a Service?

Some of the benefits of using Collection as a Service include:

- Improved collections efficiency and better recovery rates through data-driven strategies

- Reduced operational costs by eliminating in-house infrastructure expenses

- Minimized risks associated with managing delinquent accounts

- Access to specialized expertise and advanced technology

- Enhanced compliance with regulations governing debt collections practices

Is CaaS right for the lending business?

CaaS can be beneficial for lenders of all sizes, but it’s especially well-suited for those with:

- High volumes of delinquent accounts

- Limited resources for in-house collections

- A need for specialized skills or technology

- How does CaaS ensure data security and privacy?

Data security is paramount. Reputable CaaS providers prioritize data security and privacy by implementing robust security measures, such as encryption, access controls, and regular security audits, to safeguard sensitive financial and personal information.

Who can benefit from Collection as a Service?

Collection as a service can benefit various lenders, including banks, Non-banking finance companies, digital lenders, fintech companies, and other financial institutions that extend credit to consumers or businesses.

What services do CaaS providers typically offer?

- Early intervention for early delinquencies

- Collection strategies and communication across various channels (phone, email, SMS)

- Reporting and analytics on collections performance

- Legal and regulatory compliance throughout the collections process