In today’s fast-paced financial landscape, lenders must adapt to the evolving needs of their customers. The days of lengthy, complex, manual processes and paper based applications are past. Today’s customers expect seamless, quick, and transparent loan management. This is where digital loan payments software comes into play, transforming how lenders handle payments, collections, and debt recovery.

The market data validates this digital transformation. According to Redseer Strategy Consultants, digital lending is set to capture 5% of all retail loans by FY28, growing significantly from 1.8% in FY22 and 2.5% in FY24, at an impressive CAGR of 40%. This explosive growth underscores the critical importance of robust digital infrastructure.

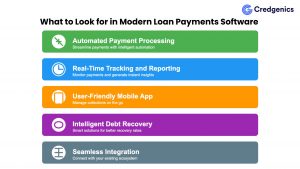

Let’s explore the 5 must-have features of digital loan payments software that every modern lender should look for to succeed in this rapidly growing digital lending market.

1. Automated Payment Processing

Why Automation Matters:

Automation is at the heart of modern fintech. A robust digital loan payments software should streamline the payment process, from recurring payment scheduling to automatic reminders and updates.

Key Benefits:

- Efficiency: Reduces manual workload, saving time and resources.

- Accuracy: Minimizes human error, ensuring accurate payment records.

- Customer Satisfaction: Enhances borrower experience by offering hassle-free, automated payment options.

Feature Spotlight:

Look for software that offers comprehensive payment integration capabilities, including UPI, bank transfers, debit cards, and digital wallets, with real-time reconciliation and OTP verification for enhanced security. The system should provide automated payment reminders across multiple channels (SMS, Email, WhatsApp, IVR), personalized white-labelled payment links, and interactive dashboards for transaction monitoring.

2. Real-Time Tracking and Reporting

Why Real-Time Data is Crucial:

In the digital age, real-time data is not just a luxury but a necessity. Real-time tracking allows lenders to monitor payments, track delinquencies, and generate instant reports.

Key Benefits:

- Immediate Insights: Enables proactive decision-making by identifying late payments or potential defaults.

- Transparency: Offers borrowers clarity on their payment status, boosting trust and engagement.

- Compliance: Ensures adherence to regulatory requirements with timely and accurate reporting.Feature Spotlight:

Opt for software that provides customizable dashboards and comprehensive reporting tools, allowing lenders to tailor insights to their needs.3. User-Friendly Mobile App for Collections

Why Mobile Accessibility is a Must:

With the rise of mobile banking, borrowers expect to manage their loans on the go. A mobile-friendly platform is essential for both borrowers and field executives handling collections.

Key Benefits: - Convenience: Allows borrowers to make payments, view balances, and manage their loans from their smartphones.

- Efficiency for Field Agents: Empowers collection teams with real-time data and updates, making field collections more effective.

- Enhanced Engagement: Mobile apps offer a direct communication channel, improving borrower-lender interaction.Feature Spotlight:

Ensure the software includes a feature-rich mobile app with secure login, easy payment options, and instant notifications for due payments and updates.4. Intelligent Debt Recovery Solutions

Why Intelligent Recovery is Essential:

Effective debt recovery is a challenge for many lenders. Traditional methods often lead to borrower dissatisfaction and lower recovery rates. However, with intelligent debt recovery solutions, lenders can leverage data and automation to enhance recovery strategies.

Key Benefits: - Enhanced Recovery Rates: Data-driven insights help identify the best recovery strategies.

- Borrower Retention: Gentle, tech-driven nudges improve borrower engagement, reducing defaults without souring relationships.

- Cost Efficiency: Automated reminders and payment follow-ups reduce the need for extensive manual intervention.Feature Spotlight:

Choose software that offers AI-driven collection strategies, such as personalized reminders and predictive analytics to forecast default risks.5. Seamless Integration Capabilities

Why Integration is Non-Negotiable:

Lenders operate in complex ecosystems involving CRM systems, accounting software, and regulatory reporting tools. A digital loan payments software must integrate seamlessly with existing systems to ensure smooth operations.Key Benefits:

- Operational Harmony: Reduces silos, ensuring all systems communicate effectively.

- Enhanced Productivity: Automates data flow between systems, reducing manual entry and errors.

- Scalability: Easy integration means the software can grow with your business needs.Feature Spotlight:

Look for APIs that facilitate smooth integration with third-party applications, ensuring a unified and efficient operational workflow.

Also Read: Accelerating digital loan repayments with Billzy

Conclusion: The Future of Lending is Digital

Modern lenders need more than just basic loan management tools; they require comprehensive solutions that offer automation, real-time insights, and enhanced recovery strategies. By adopting a digital loan payments software equipped with these must-have features, lenders can streamline operations, improve borrower experiences, and boost recovery rates.

To explore more about how cutting-edge payment solutions can transform your lending operations, check out Credgenics Billzy Payments. This powerful tool can help modern lenders achieve seamless digital loan payments and efficient debt recovery.

By integrating these critical features, lenders can stay ahead in the competitive financial landscape, delivering superior service and achieving operational excellence.

FAQs:

1. Why is automated payment processing essential for lending companies?

Automated payment processing streamlines the loan repayment process by reducing manual tasks, minimizing errors, and improving efficiency. It also enhances borrower satisfaction by offering hassle-free payment options, such as recurring payment scheduling and automated reminders.

2. What are the key features of a user-friendly mobile app for loan collections?

A user-friendly mobile app should offer secure login, easy payment options, real-time balance views, and instant notifications for due payments. For field staff, it provides real-time data and updates, making on-the-go collections more efficient and improving borrower engagement.

3. How does real-time tracking and reporting benefit lenders and borrowers?

Real-time tracking and reporting provide immediate insights into payment statuses, helping lenders make proactive decisions. It enhances transparency for borrowers, allowing them to stay informed about their loan payments and boosting trust. Additionally, it ensures compliance by offering timely and accurate reporting.

4. How do intelligent debt recovery solutions improve recovery rates and borrower relationships?

Intelligent debt recovery solutions leverage data-driven insights and automation to enhance recovery strategies. By using AI-driven reminders and predictive analytics, lenders can gently nudge borrowers, improving recovery rates while maintaining positive relationships and reducing defaults.

5. How can lenders benefit from adopting modern digital loan payments software?

By adopting modern digital loan payment software, lenders can transform their recovery operations through streamlined workflows and automated processes. The solution empowers lenders with real-time transaction insights and multi-channel communication capabilities (SMS, Email, WhatsApp, IVR), while offering borrowers a frictionless payment experience. With features like payment links, instant reconciliation, and interactive performance dashboards, lenders can accelerate collections, minimize manual effort, and make data-driven decisions.