Internet of Things (IoT) is a transformative technological paradigm that encompasses a network of interconnected devices and objects capable of exchanging data and information seamlessly. In IoT, physical objects are embedded with sensors, actuators, and connectivity, allowing them to collect and transmit data over the internet. These devices can range from household appliances and industrial machinery to wearable gadgets and smart city infrastructure. Not only is IoT impacting the financial industry, its applications span industries such as finance, healthcare, agriculture, manufacturing, transportation, and smart cities, ushering in a new era of efficiency, connectivity, and innovation.

In the modern world, where connectivity is paramount, the financial sector is poised to benefit from a digital revolution driven by the Internet of Things (IoT). As the world becomes increasingly interconnected, traditional financial paradigms are giving way to innovative technological solutions that promise to reshape the landscape of banking, investments, and financial services as we know them. The integration of IoT into the financial sector goes beyond mere convenience; it represents a fundamental shift in the way transactions are conducted, data is analyzed, and customer experiences are crafted. The key essence of IoT lies in the ability of devices to communicate with each other and with centralized systems, enabling real-time monitoring, analysis, and control. This interconnected ecosystem empowers businesses, individuals, and entire industries by providing valuable insights, automation possibilities, and enhanced decision-making capabilities. From the boardrooms of major financial institutions to the fingertips of consumers, the impact of IoT is palpable, and its implications are profound.

The transformative power of IoT has exerted influence on security protocols, customer interactions, risk management, and the overall evolution of financial ecosystems. Some of the ways in which IoT is impacting the financial industry are discussed below.

1. Smart Banking: IoT is reshaping the banking landscape through Smart Banking, where personalized and context-aware services are offered to customers. The integration of IoT devices in ATMs, resulting in ‘Smart ATMs’, ensures predictive maintenance, enhances operational efficiency, and establishes a seamless banking experience.

2. Customer experiences: IoT transforms customer experiences in banking by introducing smart wearables for contactless payments and delivering personalized financial insights. The omnichannel experiences of banking customers are significantly enhanced through the seamless integration of IoT devices. For example, people with Apple watches can tap the watch on the merchant’s device and pay through NFC. The user-friendly and evolved journeys that customers experience, as a result, are one of the greatest enablements of IoT.

3. Data analytics and decision-making: IoT-generated data empowers financial institutions with real-time insights for informed decision-making. The exploration includes the role of predictive analytics in risk management and fraud detection, showcasing the transformative impact of data-driven strategies.

4. IoT in Insurance: IoT is helping the insurance industry by introducing innovative applications that enhance risk assessment and personalized coverage. The integration of telematics devices in vehicles is revolutionizing auto insurance through usage-based premiums, providing insurers with real-time data on policyholders’ driving behavior. IoT-enabled advancements not only optimize the insurance process but also offer a more tailored and responsive approach to coverage, ultimately transforming the traditional landscape of the insurance industry.

5. Efficiency and cost reduction: IoT is streamlining operations and reducing costs for financial institutions by enabling predictive maintenance and efficient resource utilization. Case studies are explored to showcase tangible benefits, illustrating how IoT implementation positively influences various financial processes.

6. Chatbots: One major use case of IoT impacting the financial industry is the deployment of chatbots. The advent of IoT has prompted established players to enhance customer service through the deployment of virtual assistants or chatbots. These intelligent chatbots leverage natural language processing and machine learning, continually enhancing their capabilities with each customer interaction to deliver a progressively personalized experience. A case in point is Capital One’s Eno, the pioneering natural language SMS text-based assistant in the U.S. banking sector. Eno excels at alerting customers to suspected fraud, potential double charges from merchants, or overly generous tips, showcasing the evolving landscape of customer interaction in the financial domain.

7. Blockchain and smart contracts: Blockchain possesses the capability to streamline cross-border payments and enhance the efficiency of trade finance processes, with financial institutions dedicating approximately $1.7 billion annually to blockchain technology investments. Recognizing the significance of digital solutions, banks are compelled to allocate substantial resources to meet evolving consumer needs. The integration of the Internet of Things (IoT) into banking operations not only addresses security and privacy concerns but also facilitates the adoption of blockchain for robust customer authentication. Insider Intelligence notes that leveraging blockchain for identity authentication offers an immutable record, preventing alterations to logged identity credentials. This underscores the pivotal role of IoT in empowering banks to bolster their digital offerings and stay at the forefront of technological advancements.

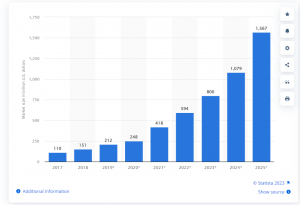

Forecast: End-user spending on IoT solutions worldwide from 2017 to 2025

Source: Statista 2023

India and the Internet of Things

As per a Statista report,

- The IoT market in India is forecasted to reach ₹US$27.31 billion by 2023, with significant growth expectations.

- Industrial IoT emerges as a dominant player, projected to have a market volume of ₹US$9.67 billion in 2023, particularly prominent in the automotive sector.

- The IoT market is poised for an impressive annual growth rate of 17.05% from 2023 to 2028, expanding the market volume to ₹US$60.01 billion by 2028.

- This growth reflects the increasing adoption of IoT solutions across diverse industries within the country.

- India’s IoT market is flourishing, driven by smart city initiatives and widespread adoption in the agriculture and healthcare sectors.

- The figures underscore the substantial potential and opportunities the IoT market holds for India, reinforcing its position in the global IoT landscape amid ongoing digital transformation.

Conclusion

From transforming customer experiences to enhancing security and efficiency, the symbiotic relationship between IoT and finance is reshaping the ecosystem of the country. The recent trends in IoT in India reflect a dynamic landscape where connected technologies are catalyzing advancements across diverse sectors. As the nation embraces the era of smart solutions, the integration of IoT is poised to play a pivotal role in driving innovation, sustainability, and efficiency across various facets of Indian society and industry.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com

FAQs:

1. How is IoT impacting the financial industry?

The impact of the Internet of Things (IoT) on the financial industry is transformative, revolutionizing various facets of banking and finance. Smart banking services, enabled by IoT, provide personalized experiences and predictive maintenance for ATMs, enhancing operational efficiency. Customer interactions have evolved through smart wearables, contactless payments, and omnichannel experiences. The integration of IoT addresses security challenges through innovative measures like biometrics and blockchain. Additionally, IoT-generated data empowers financial institutions with real-time insights for informed decision-making, while its influence extends to the insurance sector through telematics devices. The overall result is streamlined operations, cost reduction, and a dynamic shift in the way financial services are delivered.

2. How does IoT enhance customer experiences in the financial industry?

IoT transforms customer experiences by enabling personalized and context-aware services. From smart wearables for contactless payments to providing personalized financial insights, IoT creates seamless and omnichannel experiences, offering customers more convenience and tailored services.

3. What security challenges does IoT pose in financial transactions?

With IoT impacting the financial industry in a major way, the proliferation of IoT devices in financial transactions raises security concerns. To mitigate risks, innovative security measures like biometrics and blockchain are employed. These technologies help safeguard sensitive financial data and ensure secure interactions in the evolving IoT-driven financial landscape.

4. How does IoT contribute to efficiency and cost reduction in financial institutions?

IoT streamlines operations and reduces costs for financial institutions through predictive maintenance and efficient resource utilization. By leveraging IoT-generated data, institutions gain real-time insights for informed decision-making, enhancing overall operational efficiency and cost-effectiveness.