Debt collections is an important pillar in lending as it directly impacts the lender’s overall revenue and profitability. Growing purchasing power is accelerating the consumption of debt-based products in India, thereby, creating a promising growth opportunity for lenders. But at the same time, the need to recover debts is also increasing due to multiple factors. This brings forth the need to focus on improving collections and enhancing the operational efficiencies in this area and start considering debt collection through automation.

According to the recent RBI reports¹, the overall gross non-performing assets in the banking sector are expected to rise to 8.1% by September 2022 and may reach 9.5% in the event of extreme stress. The challenges posed by the pandemic over the past two years and the prevailing economic sentiments worldwide are further likely to keep collections under the radar for lenders.

Regardless, with automated and digital processes backed by data-driven insights, financial institutions can manage collections effectively and boost their debt collection rates.

The traditional and manual debt collection approach requires relentless chasing of borrowers after the loan default, which is a problem in the lending sector. However, loan recovery is also delayed because of certain challenges in the internal collection process such as:

- Archaic operations rely on manual processes and human intervention

- Multiple teams / functions / solution providers operating in siloes

- Manual updating of payment activity and status

- Missing tracking of debt field collection agents

- Broken / lack of seamless communications with debtors and internal teams

- Language barrier in debt collections

For all the challenges listed above, automation and digitization of the debt collections process is the solution. It begins with identifying the defaulters to the final settlement of funds. One of the best enablers of automation and digitization in debt recovery is the Credgenics debt collection platform which automates and streamlines the entire collection process, including nudging customers to pay with integrated communications across channels, integrating payment gateways, and managing legal processes. It helps in personalized engagement with borrowers through AI-driven collection strategies and increases overall collection rates. Businesses can see immediate results once they start automating.

Automation significantly improves both the recovery time and efficiency of the collection process. Digital solutions make it easier for lenders to prioritize their efforts for maximum outcomes, fast-track processes, get real-time visibility and transform the customer experience for brand loyalty.

Dashboard & Data Analytics

In debt collections, dashboards play an important role as they provide a quick and consolidated view of various collections activities across different stages and channels. With multiple digital engagements going on simultaneously, it is critical to assess their performance periodically and tweak the approach to fine-tune it based on the evolving dynamics. The data-driven insights are extremely helpful in ensuring that the collections campaigns and strategies are aligned and driven towards the attainment of specific objectives.

Credgenics platform dashboards derive loan case data from API-based integration with lenders’ loan management systems. The dashboards cover the stage of each delinquent case, loan amount recovered, communication channels used, and status of legal communication triggered and its response. These dashboards are an easy feature to devise further strategies for difficult cases and require adept data analytics. The analytics uses machine learning models to analyze the data at each stage and based on the borrower’s response, the data is passed to the next stage collections team for further action. Credgenics dashboards cater to the needs of multiple stakeholders such as collections heads and branch managers by showing the data relevant to those users, which enables them to make the best decisions.

Digital Communications

Digital Communications provides completely automated and digitized communications capabilities across multiple channels throughout the loan collections life cycle. Having a robust digital communications platform enables lenders to use innovative and sophisticated features to effectively manage borrower communications across stages. Some of the features of automated digital communications are highlighted in the video featured on the left side.

Calling

Calling continues to be an integral part of loan collections, especially in certain stages of delinquency buckets. It is sensitive in nature as it involves a direct human-to-human interaction and the experience can make an impression on the borrower’s mind about the lender, impacting customer loyalty metrics.

The financial institutions need a technology platform that offers comprehensive calling capabilities to remind debtors of repayments and help them address problems such as payment shortfall.

Credgenics calling solutions offer automated cloud-based calling where the borrower’s numbers are masked, and the caller’s tone and language are monitored through call recordings available on the platform.

Enabling Digital Payments for loan collections

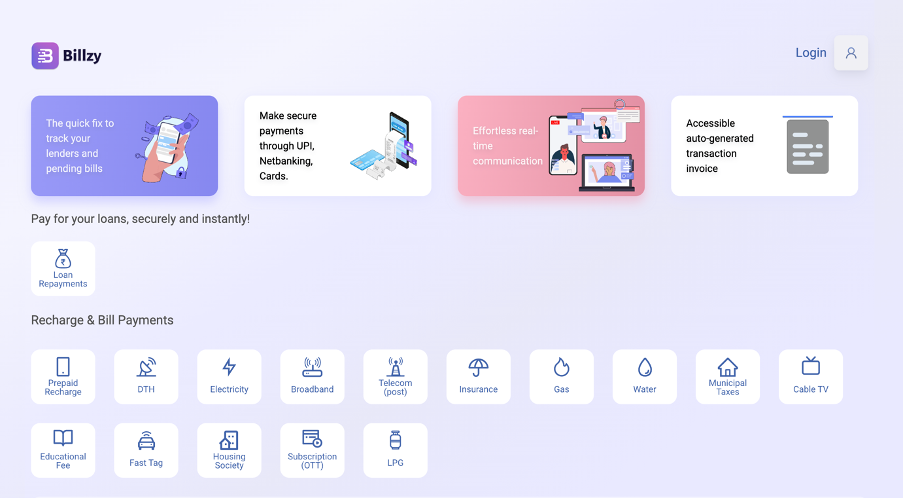

By enabling digital payments for loan collections, lenders can provide simpler, faster, and more secure digital payment capabilities to their loan borrowers. Billzy is one such platform where lenders get complete visibility on the loan repayments in real-time through its integration with the Credgenics loan collections platform. The borrowers can use it to simplify and consolidate all their transactions for other bills.

A quick snapshot of Billzy:

Maintain an updated borrower information

The change of borrowers’ contact numbers and addresses creates a huge gap for banks and other financial services companies in reaching out to their existing borrowers if their new contact details have not been updated. Sometimes, this information is required to close the long ongoing loan accounts.

Credgenics Skip Tracing streamlines the process of identifying and updating contact details making it faster, efficient, and more accurate while adhering to ethics. The solution tracks the public digital footprint of the loan borrowers within the specified norms of data privacy to identify their secondary/new contact details. In case these are not available, the loan co-applicants or references or witnesses provided to the lender are contacted. Credgenics uses borrower’s preliminary information provided to the lending companies including primary phone number, loan accounts related details such as account number, email address and residential address, Know Your Customers (KYC) documents such as national identity number (Aadhaar ID, voter ID) and Income tax number (PAN). Using these inputs, the tool discovers additional information such as additional contact phone numbers, email addresses, names of references and similar information.

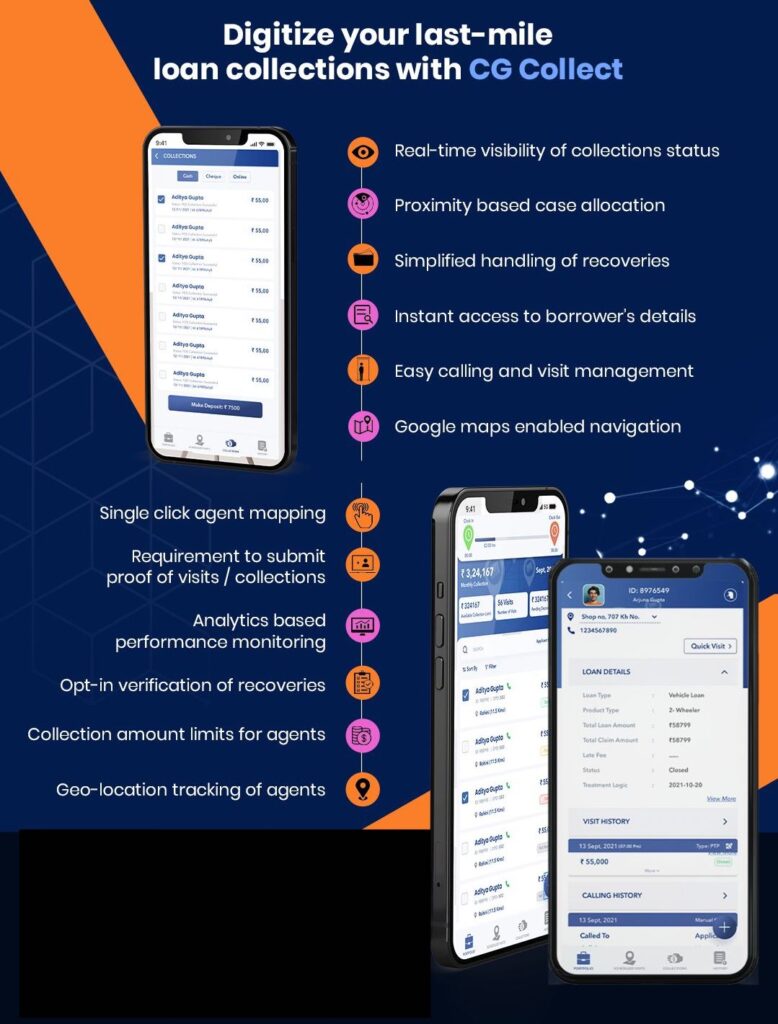

Digital door-to-door recovery solutions

Door-to-door loan recoveries are one of the most difficult processes for lenders. A digitized platform for field collections can help bring efficiencies, provide real-time visibility, eliminate cash from collections, remove the need for paper receipts and bring the desired improvement in customer experiences. One such mobile app is CG Collect from Credgenics.

CG Collect is an advanced technology solution for door-to-door loan recoveries that enables lenders to completely digitize their on-field loan collections leading to higher operational efficiencies, enhanced team productivity, and boosted collections. The solution, specifically designed for lending businesses, comprises a web-based application for managers or office staff, and a mobile app installed on the field agent’s and manager’s mobile phones. CG Collect allows lenders to monitor their operations in real-time, digitize collections to the last mile, simplify collections processes, and transform the customer experience.

Some of the features of the CG Collect app:

Final Thoughts

Even though financial institutions have all the data points from loan defaulters, they are unable to use the data efficiently. Lack of integrated approach, missing appropriate tools, and relying on manual processes need to be investigated. Some financial institutions operate with inadequate insights and a complicated approach to collections, which hampers their profitability and brand image in the long term.

Leveraging automation and digitization can make debt collections more efficient and reduce compliance-related issues. To a large extent, an advanced debt collection automation system can break through the siloed infrastructure and legacy systems to unlock profitability.

The best solution for dealing with all these problems is to automate the collection using debt collection software or debt collections CRM which allows lenders to have proper records and efficiently predict and prioritize debt recovery.

Author- Mridul C.P- Digital Marketing Manager, Credgenics

Debt Recovery FAQs

1. What is debt recovery in banking?

Debt recovery refers to collecting due payments for a debt, which the borrower owes to the lender. The debt could be an ongoing one or written off and considered uncollectible by the lender. This receivable can be in the form of a credit line, loan or any other accounts receivable. A bank takes recovery action for several reasons, but the most common is when a customer fails to repay their loans at the time.

2. What is debt collection?

Debt collection is when a collection agency or company tries to collect past-due debts from borrowers. You might be contacted by a debt collector if you haven’t made loan or credit card payments and those payments are severely past due.

3. What are the benefits of debt collections through automation?

Debt collection through automation will help lenders in the following ways:

- 20% increase in resolution rates

- 5x return on investment by implementing automated debt recovery

- 10% reduction in collections costs

- 80% resolution of bad debts

- 20% reduction in collection times

4. How do NPA affect banks and lending institutions?

When NPAs increase, the proportion of interest-earning assets falls, which leads to a fall in interest income, and hence ROA declines. Thus, NPAs and ROA have a negative relation; as NPA rises, the return on assets (ROA) of banks falls.

5. What are debt collection methods?

Lenders deploy several methods to recover dues from borrowers. Some of which include reaching out to customers, allocating cases to call centres or third-party agencies, adopting legal measures or even selling debts at a loss.

Reserve Bank of India: Financial Stability Report, December 2021