Availing finance often poses significant challenges for SMEs, including lengthy approval times, cumbersome paperwork, and stringent eligibility criteria. In recent years, the emergence of fintech solutions has shaken up the small business lending ecosystem, offering innovative and accessible alternatives to traditional bank loans.

For small and medium-sized enterprises (SMEs), access to capital is the lifeblood of growth and success. However, traditional lenders often shy away from SMEs due to perceived risks and complex approval processes. This is where fintech, or financial technology, comes in, offering innovative solutions that are transforming the small business lending landscape.

India boasts over 60 million MSMEs, with micro-enterprises comprising over 95 percent of this vast landscape. A significant majority of these enterprises, nearly 60 percent, are situated in rural regions, and approximately 70 percent are active in the services sector. These MSMEs can be identified by their lack of formal documentation, reliance on cash transactions, and restricted asset ownership. Moreover, they encounter a multitude of challenges that vary across different geographical locations, markets, products, and local cultures. Consequently, adopting a uniform approach to finance is not viable, as the diverse needs and circumstances of MSMEs demand tailored solutions.

While micro, small, and medium enterprises (MSMEs) are the backbone of India’s industrial scene, contributing a significant percentage to the GDP and exports, a critical piece of the puzzle remains hidden. Despite their impressive contribution, MSMEs face a unique challenge due to their inherent diversity. Scattered across various industries and often unorganized, their heterogeneity creates hurdles in their journey towards expansion, modernization, and embracing technological advancements.

Here’s a fresh perspective on the situation:

- Imagine a vibrant ecosystem composed of millions of entrepreneurial engines, each driving different segments of the economy. This is the essence of India’s MSME landscape.

- However, this very strength – diversity – becomes a double-edged sword. The lack of uniformity makes it difficult to implement uniform policies or provide targeted support.

- Then try to equip a diverse army with standardized weapons. It wouldn’t be very effective, would it? The same applies to MSMEs. Each segment has unique needs and requires tailored solutions.

Moving forward, a multi-pronged approach is crucial:

1. Data-driven insights: Understanding the specific needs and challenges of each MSME segment through detailed data analysis is key.

2. Targeted support: Offering customized training, financial assistance, and technology adoption programs that cater to the unique needs of different industries within the MSME sector.

3. Collaborative ecosystem: Fostering partnerships between MSMEs, large corporations, academia, and research institutions to facilitate knowledge sharing and technology transfer.

By unlocking the full potential of its MSME sector, India can truly unleash a wave of inclusive economic growth and modernization. Let us take a closer look at the pertinent challenges that small businesses face when it comes to digital lending.

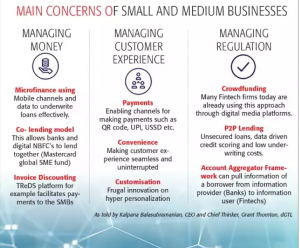

Understanding the Challenges of Small Business Lending

For the countless small businesses that fuel local economies, accessing the capital needed to thrive is a cumbersome task. Traditional lenders, often focused on minimizing risk, throw up a series of hurdles at every turn.

1. First, there’s the access issue. Their “David vs. Goliath” size compared to large corporations makes them inherently less attractive borrowers. Lack of lengthy credit history or substantial collateral further strengthens the perception of risk, often slamming the door shut on funding opportunities.

2. Even if they qualify, the journey is far from smooth. Traditional lenders often demand a mountain of paperwork, detailed business plans, and extensive financial statements. This data gathering can be a resource-intensive burden, especially for young businesses with limited staff and expertise.

Source: The Economic Times

3. As if these barriers weren’t enough, the price tag adds another layer of pain. High-interest rates and stringent repayment terms, reflective of the perceived risk, squeeze already tight margins. Shorter loan tenures and frequent payments can create a cash flow chokehold, hindering the ability to invest in expansion or weather unexpected hiccups.

4. The complexity adds another layer of frustration. Navigating the application process is like solving a complex puzzle. From gathering documents to securing guarantees, each step demands time, effort, and often external help, adding further strain to their limited resources.

This frustrating reality stifles the potential of countless small businesses, the very entities that create jobs, innovation, and local wealth. It’s a call to action for alternative solutions, like fintech options, that prioritize agility, inclusivity, and a level playing field for these economic engines.

The Rise of Fintech Solutions for SME Lending

Fintech companies have emerged as disruptors in the small business lending space, leveraging technology and data analytics to address the challenges faced by SMEs. These innovative solutions offer several advantages:

1. Speed and Efficiency: Fintech platforms simplify the lending process by leveraging technology platforms and automation capabilities. Unlike traditional lending institutions, which often involve lengthy paperwork and manual processes, fintech platforms offer rapid and efficient loan approvals. Through digitized workflows and automated decision-making algorithms, fintech lenders can assess loan applications swiftly, often within days or even hours. This expedited approval process contrasts starkly with the weeks or months typically required by traditional lenders, enabling SMEs to access funds quickly to address urgent financial needs or capitalize on growth opportunities.

2. Accessibility: Fintech solutions harness the power of digital platforms to democratize access to financing for SMEs. By eliminating geographical barriers, fintech lenders make financing opportunities available to businesses regardless of their location. This is particularly beneficial for SMEs operating in underserved or remote areas that may have limited access to traditional banking services.

3. Flexible Terms: Fintech lenders offer SMEs greater flexibility in loan terms compared to traditional financial institutions. Recognizing the diverse needs and circumstances of small businesses, fintech lenders tailor loan products to accommodate specific requirements. This flexibility extends to interest rates, repayment schedules, and collateral options, allowing SMEs to customize financing solutions that align with their cash flow projections and growth objectives.

4. Data-Driven Decision-Making: Fintech companies leverage advanced data analytics and algorithms to enhance credit assessment processes. By analyzing a diverse array of data sources, including financial records, transaction history, and business performance metrics, fintech lenders gain deeper insights into a borrower’s creditworthiness. This holistic view enables more informed lending decisions, reducing the reliance on traditional credit scores and mitigating the risk of default.

5. Competitive Rates: Fintech lenders can offer more competitive interest rates and fees for SMEs by leveraging technology to lower operational costs. Compared to traditional lenders burdened by legacy systems and brick-and-mortar infrastructure, fintech companies operate with greater efficiency and scalability. By automating processes, minimizing overhead expenses, and optimizing risk management strategies, fintech lenders can pass on cost savings to SME borrowers in the form of competitive rates and fees.

Fintech Solutions for SMEs

Several fintech solutions have emerged to address the financing needs of SMEs:

1. Online Lending Platforms: These platforms connect small businesses with investors or lenders willing to provide funding, offering a seamless and transparent borrowing experience.

2. Invoice Financing: Fintech companies offer invoice financing solutions, allowing SMEs to leverage their accounts receivable to access immediate cash flow, without waiting for customer payments.

3. Peer-to-Peer (P2P) Lending: P2P lending platforms facilitate direct lending between individuals or investors and small businesses, eliminating the need for traditional financial intermediaries.

4. Credit Scoring and Risk Assessment Tools: Fintech solutions use alternative data sources and predictive analytics to assess credit risk, enabling SMEs to access financing based on their business performance rather than traditional credit scores.

5. Alternative Data Scoring: Companies use alternative data sources to create credit scores, expanding access to funding for businesses with limited traditional credit histories.

6. Crowdfunding: Some platforms allow SMEs to raise capital directly from the public, bypassing traditional lenders altogether.

In recent years, neobanks have emerged as disruptors in the financial sector, often referred to as ‘challenger banks’ for their ability to challenge the complex infrastructure and client onboarding processes of traditional banks. Neobanks, essentially financial institutions, offer customers a cost-effective alternative to traditional banking services. They capitalize on technology and artificial intelligence to deliver personalized services while keeping operating costs to a minimum.

Another transformative development in the fintech landscape is the rise of account aggregators (AAs). Account aggregators serve as a pivotal framework facilitating the real-time and encrypted sharing of financial information between regulated entities such as banks and non-banking financial companies (NBFCs). This seamless data exchange occurs between financial information providers (FIPs) and financial information users (FIUs), enabling banks to access consented and verified data flows. By reducing transaction costs, AAs empower banks to offer lower ticket-size loans and more tailored products and services to their clientele, enhancing operational efficiency and customer satisfaction.

Fintech holds the promise of enhancing financial inclusion by bridging the last-mile connectivity gap. With the advent of co-lending arrangements within the financial ecosystem, collaborations between banks and fintech companies are poised to transform the landscape. By leveraging their respective strengths, these partnerships facilitate the provision of first and last-mile services to micro, small, and medium-sized enterprises (MSMEs). The extensive reach of traditional banks, combined with the digital prowess and innovation of fintech-led NBFCs, ensures that MSME borrowers can access finance from even the most remote corners of the country.

The Future of SME Lending: Opportunities and Challenges

One of the most significant promises of fintech lies in its ability to extend the reach of financing to previously underserved segments of the SME market. This opens doors for new generations of entrepreneurs, fosters innovation, and drives economic growth across diverse industries. Imagine the potential for women-led businesses, rural enterprises, and startups in untapped sectors – all empowered by the accessibility of fintech solutions.

As fintech ventures into uncharted territory, the existing regulatory frameworks need to evolve to accommodate its unique characteristics. Striking a balance between fostering innovation and ensuring consumer protection and financial stability is crucial. Collaborative efforts between regulators, industry leaders, and technology experts are essential to create a supportive environment that paves the way for responsible and sustainable growth.

Unlocking Potential: A Brighter Future for SMEs

In conclusion, the integration of fintech solutions into SME lending opens up a world of possibilities. From expanded access to capital and flexible offerings to increased efficiency and reduced costs, the benefits are undeniable. As technology continues to evolve and regulatory frameworks adapt, the future of SME lending holds immense promise for driving economic prosperity and entrepreneurial success across the globe. By embracing fintech solutions and navigating the challenges they present, SMEs can unlock their full potential and contribute to a more vibrant and dynamic global economy.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

1. What are fintech solutions, and how do they benefit SMEs?

Fintech solutions are financial technologies that leverage digital innovation to offer efficient and accessible financial services. Fintech solutions for SMEs provide numerous benefits, including streamlined access to financing, faster approval processes, lower transaction costs, and personalized financial products tailored to their specific needs. By embracing fintech solutions, SMEs can improve their cash flow management, enhance operational efficiency, and accelerate business growth.

2. What types of fintech solutions are available for SMEs?

There are various types of fintech solutions designed to cater to the diverse needs of SMEs. These include online lending platforms, invoice financing services, digital payment solutions, accounting and bookkeeping software, cash flow management tools, and business analytics platforms. Each of these fintech solutions addresses specific pain points faced by SMEs, such as accessing capital, managing cash flow, optimizing financial processes, and making data-driven business decisions.

3. How do fintech lending platforms differ from traditional banks for SME financing?

Fintech lending platforms offer several advantages over traditional banks for SME financing. Firstly, fintech lending platforms leverage technology and data analytics to streamline the loan application process, resulting in faster approval times and minimal documentation requirements. Additionally, fintech lending platforms often provide more flexible loan terms, lower interest rates, and alternative collateral options, making them more accessible and affordable for SMEs compared to traditional banks. Moreover, fintech lending platforms utilize innovative credit assessment models that consider a broader range of factors beyond traditional credit scores, enabling them to serve a wider segment of SMEs, including those with limited credit history or collateral.

4. Are fintech solutions secure and reliable for SMEs?

Yes, fintech solutions prioritize security and reliability to safeguard the financial data and transactions of SMEs. Fintech companies employ advanced encryption techniques, secure authentication protocols, and robust cybersecurity measures to protect sensitive information and ensure data privacy. Additionally, fintech solutions comply with regulatory standards and undergo regular audits and assessments to maintain the highest standards of security and reliability. SMEs can trust fintech solutions to provide secure and reliable financial services that meet their business needs while mitigating risks associated with cyber threats and data breaches.